NCERT Solutions for Class 12 Business Studies Chapter 9 Financial Management

Short Answer Type Questions

1. What is meant by capital structure?

Ans: Capital structure refers to the mix between owners and borrowed funds. It represents the proportion of equity and debt

2. Discuss the two objectives of Financial Planning.

Ans: Financial Planning strives to achieve the following two objectives

(i) To Ensure Availability of Funds whenever These are Required This includes a proper estimation of the funds required for different purposes such as for the purchase of long term assets or to meet day-to-day expenses of business etc.

(ii) To See That the Firm Does Not Raise Resources Unnecessarily

Excess funding is almost as bad as inadequate funding. Efficient financial planning ensures that funds are not raised unnecessarily in order to avoid unnecessary addition of cost.

3. What is ‘financial risk? Why does it arise?

Ans: It refers to the risk of company not being able to cover its fixed

financial costs. The higher level of risks are attached to higher degrees of

financial leverage with the increase in fixed financial costs, the company its

also required to raise its operating profit (EBIT) to meet financial charges. If

the company can not cover these financial charges, it can be forced into liquidation.

4. Define a ‘current assets’ and give four examples.

Ans: Current assets are those assets of the business which can be converted into cash within a period of one year. Cash in hand or at bank,

bills receivables, debtors, finished goods inventory are some of the examples of current assets.

5. Financial management is based on three broad financial decisions. What are these?

Ans: Financial management is concerned with the solution of three major issues relating to the financial operations of a firm corresponding to the three questions of investment, financing and dividend decision. In a financial context, it means the selection of best financing alternative or best investment alternative. The finance function therefore, is concerned with three broad decision which are as follows

(i) Investment Decision

The investment decision relates to how the firm’s funds are invested in different assets.

(ii) Financing Decision

This decision is about the quantum of finance to be raised from various long term sources and short term sources. It involves identification of various available sources of finance.

(iii) Dividend Decision

This decision relates to distribution of dividend. Dividend is that portion of profit which is distributed to shareholders the decision involved here is how much of the profit earned by company is to be distributed to the shareholders and how much of it should be retained in the business for meeting investment requirements.

6. What is the main objective of financial management? Explain briefly.

Ans: Primary aim of financial management is to maximise shareholder’s wealth, which is referred to as the wealth maximisation concept. The wealth of owners is reflected in the market value of shares, wealth maximisation means the maximisation of market price of shares.

According to the wealth maximisation objective, financial management must select those decisions which result in value addition, that is to say the benefits from a decision exceed the cost involved. Such value addition I increase the market value of the company’s share and hence result in maximisation of the shareholder’s wealth.

7. Discuss about working capital affecting both the liquidity as well as profitability of a business.

Ans: The working capital should neither be more nor less than ; required. Both these situations are harmful. If the amount of working capital

is more than required, it will no doubt increase liquidity but decrease profitability. For instance, if large amount of cash is kept as working capital, i then this excessive cash will remain idle and cause the profitability to fall.

On the contrary, if the amount of cash and other current assets are very ‘ little, then lot of difficulties will have to be faced in meeting daily expenses

and making payment to the creditors. Thus, optimum amount of both current assets and current liabilities should be determined so that profitability of the business remains intact and there is no fall in liquidity.

Long Answer Type Questions

1. What is meant by working capital? How is it calculated?

Discuss five important determinants of working capital requirements.

Ans: Working capital is that part of total capital which is required to H meet day-to-day expenses, to buy raw materials, to pay wages and other

expenses of routine nature in the production process or we can say it refers 2 to excess of current assets over current liabilities.

Working Capital = Current Assets – Current Liabilities

Factors affecting working capital requirement are

2 (i) Nature of Business The basic nature of a business influences the

amount of working capital required. A trading organisation usually needs a lower amount of working capital compared to a manufacturing organisation. This is because in trading, there is no processing required. In a manufacturing business, however, raw materials need to be converted into finished goods, which increases the expenditure on raw material, labour and other expenses,

(ii) Scale of Operation The firms which are operating on a higher scale of operations, the quantum of inventory, debtors required is generally high, Such organisations, therefore, require large amount of working capital as compared to the organisations which operate on a lower scale.

(iii) Production Cycle Production cycle is the time span between the receipts of raw materials and their conversion into finished goods.

Some businesses have a longer production cycle while some have a shorter one. Working capital requirement is higher in terms with longer processing cycle and lower in firms with shorter processing cycle.

(iv) Credit Allowed Different firms allow different credit terms to their customers. A liberal credit policy results in higher amount of debtors, increasing the requirements of working capital.

(v) Credit Availed Just as a firm allows credit to its customers it also may get credit from its suppliers. The more credit a firm avails on its purchases, the working capital requirement is reduced.

2. Capital structure decision is essentially optimisation of risk-return relationship. Comment.

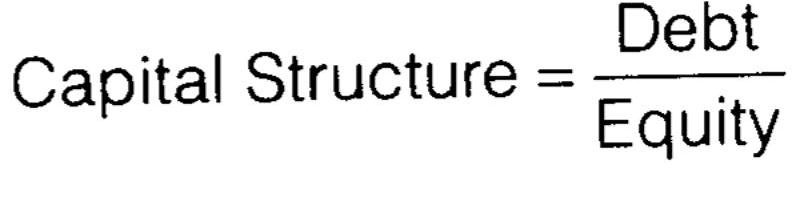

Ans: Capital structure refers to the mix between owners and borrowed funds. It can be calculated as Debit/Equity.

Debt and equity differ significantly in their cost and riskiness for the firm. Cost of debt is lower than cost of equity for a firm because lender’s risk is lower than equity shareholder’s risk, since lenders earn on assured return and repayment of capital and therefore they should require a lower rate of return. Debt is cheaper but is more risky for a business because payment of interest and the return of principal is obligatory for the business. Any default in meeting these commitments may force the business to go into liquidation. There is no such compulsion in case of equity, which is therefore, considered riskless for the business. Higher use of debt increases the fixed financial charges of a business. As a result increased, use of debt increases the financial risk of a business.

Capital structure of a business thus, affects both the profitability and the financial risk. A capital structure will be said to be optimal when the proportion of debt and equity is such that it results in an increase in the value of the equity share.

3. A capital budgeting decision is capable of changing the financial fortune of a business. Do you agree? Why or why not?

Ans: Investment decision can be long term or short term. A long term investment decision is also called a capital budgeting decision. It involves commiting the finance on a long term basis, e.g., making investment in a new machine to replace an existing one or acquiring a new fixed assets or opening a new branch etc. These decisions are very crucial for any business. They affect its earning capacity over the long-run, assets of a firm, profitability and competitiveness, are all affected by the capital budgeting decisions. Moreover, these decisions normally involve huge amounts of investment and are irreversible except at a huge cost. Therefore, once made, it is almost impossible for a business to wriggle out of such decisions. Therefore, they need to be taken with utmost care. These decisions must be taken by those who understand them comprehensively A bad capital budgeting decision normally has the capacity to severely damage the financial fortune of a business.

4. Explain factors affecting the dividend decision.

Ans: Dividend decision relates to distribution of profit to the shareholders and its retention in the business for meeting the future investment requirements.

How much of the profits earned by a company will be distributed as profit and how much will be retained in the business is affected by many factors. Some of the important factors are discussed as follows

(i) Earnings Dividends are paid out of current and past year earnings. Therefore, earnings is a major determinant of the decision about dividend.

(ii) Stability of Earnings Other things remaining the same, a company having stable earning is in a position to declare higher dividends. As against this, a company having unstable earnings is likely to pay smaller dividend.

(iii) Growth Opportunities Companies having good growth opportunities retain more money out of their earnings so as to finance the required investment. The dividend in growth companies, is therefore, smaller than that in non-growth companies.

(iv) Cash Flow Position Dividends involve an outflow of cash. A company may be profitable but short on cash. Availability of enough cash in the company is necessary for declaration of dividend by it.

(v) Shareholder Preference If the shareholder in general, desire that at least a certain amount should be paid as dividend, the companies are likely to declare the same.

(vi) Taxation Policy If tax on dividend is higher it would be better to pay less by way of dividends. As compared to this, higher dividends may be declared if tax rates are relatively lower.

(vii)Stock Market Reaction For investors, an increase in dividend is a good news and stock prices react positively to it. Similarly, a decrease in dividend may have a negative impact on the share prices in the stock market.

(viii) Access to Capital Market Large and reputed companies generally have easy access to the capital market and therefore, depend less on retained earnings to finance their growth. These companies tend to pay higher dividends than the smaller companies which have relatively low access to the market.

(ix) Legal constraints Certain provisions of the Company’s Act place restriction on payouts as dividend. Such provisions have to be adhered, while declaring dividends.

(x) Contractual Constraints While granting loans to a company, sometimes the lender may impose certain restrictions on the payment of dividends in future. The companies are required to ensure that the dividends does not violate the terms and conditions of the loan agreement in this regard.

5. Explain the term ‘trading on equity’. Why, when and how it can used by a business organisation?

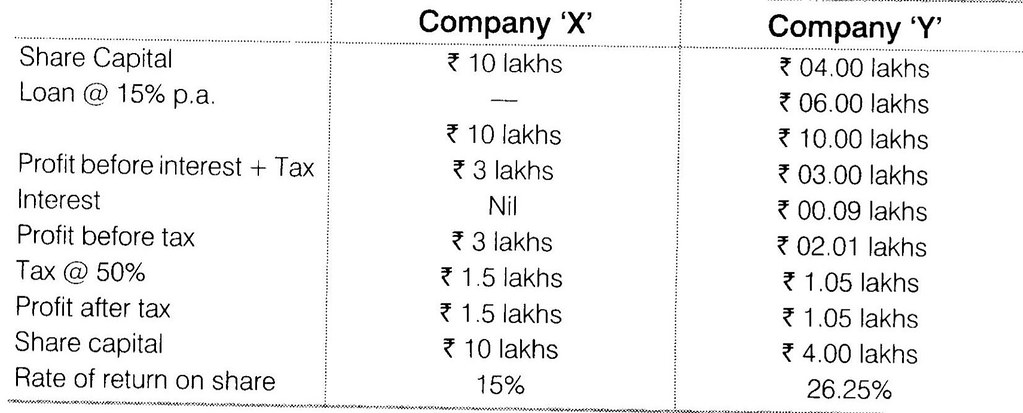

Ans: Trading on equity refers to the increase in profit earned by the equity shareholders due to presence of fixed financial charges. When the rate of earning or Return on Investment (ROI) of a company is higher than the rate of interest on borrowed funds only then a company should opt for trading on equity. Let us consider the following example

It should be clear from the above example, that shareholders of the company ‘X’ have a higher rate of return than company ‘Y’ due to loan component in the total capital of the company.

Case Problem

‘S’ Limited is manqufacturing steel at its plant in India. It is enjoying a buoyant demand for its products as economic growth is about 7%-8% and the demand for steel is growing. It is planning to set up a new steel plant to cash on the increased demand it is facing. It is estimated that it will require about ? 5,000 crores to set up and about t 500 crores of working capital to start the new plant.

1. What is the role and objectives of financial management for this company?

Ans: Role of Financial Management Financial management is concerned with the proper management of funds. It involves

(i) Managerial decisions relating to procurement of long term and short term funds.

(ii) Keeping the risk associated with respect to procured funds under control.

(iii) Utilisation of funds in the most productive and effective manner

(iv) Fixed debt equity ratio in capital.

Objective of Financial Management

The objective of financial management is maximisation of shareholder’s wealth. The investment decision, financial decision and dividend decision help an organisation to achieve this objective. In the given situation, S limited envisages growth prospects of steel industry due to the growing demand. To expand the production capacity, the company needs to invest. However, investment decision will depend on the availability of funds, the financing decision and the dividend decision. However, the company will take those financial decisions which result in value addition, i.e., the benefits are more than the cost. This leads to an increase in the market value of the shares of the company.

2. Explain the importance of having a financial plan for this company. Give an imaginary plan to support your answer.

Ans: Importance of financial plan for the cpmpany

(i) Financial Planning ensures provision of adequate funds to meet working capital requirements.

(ii) It brings about a balance between in flow and out flow of funds and ensures liquidity throughout the year.

(iii) It solves the problems of shortage and surplus of funds and ensures proper and optimum utilisation of available resources.

(iv) It ensures increased profitability through cost benefit analysis and by avoiding wasteful operations.

(v) It seeks to eliminate waste of funds and provides better financial control.

(vi) It seeks to avail the benefits of trading on equity

3. What are the factors which will affect the capital structure of this company?

Ans: Capital structure refers to the proportion in which debt and equity funds are used for financing the operations of a business. A capital structure is said to be optimum when the proportion of debt and equity is such that it results in an increase in the value of shares. The factors that will affect the capital structure of this company are

(i) Equity Funds The composition of equity funds in the capital structure will be governed by the following factors

(a) The requirement of funds of ‘S’ Limited is for long term. Hence, equity funds will be more appropriate.

(b) There are no financial risks attached to this form of funding.

(c) If the stock market is bullish, the company can easily raise funds through issue of equity shares.

(d) If the company already has raised reasonable amount of debt funds, each subsequent borrowing will come at a higher interest rate and will increase the fixed charges.

(ii) Debt Funds The usage and the ratio of debt funds in the capital structure will be governed by factors like

(a) The availability of cash flow with the company to meet its fixed financial charges. The purpose is to reduce the financial risk associated with such payments which can further be checked by using ‘debt’ service coverage ratio.

(b) It will provide the benefit of trading on equity and hence will increase the earning per share of equity shareholders. However, ‘return on investment’ ratio will be the guiding principle behind it. The company should opt for trading on equity only when return on investment is more than the fixed charges.

(c) Interest on debt funds is a deductible expense and therefore, will reduce the tax liability.

(d) It does not result in dilution of management control.

4. Keeping in mind that it is a highly capital intensive sector what factors will affect the fixed and working capital. Give reasons with regard to both in support of your answer.

Ans: The working and fixed capital requirement of ‘S’ Limited will be high due to the following reasons

(i) The business is capital intensive and the scale of operation is large.

(ii) Heavy investments are required for building up the production base and for technological upgradation.

(iii) In case of steel industry, the major input is iron ore and coal. The ratio of cost of raw material to total cost is very high. Hence, higher will be the need for working capital.

(iv) The longer the operating cycle, the larger is the amount of working capital required as the funds get locked up in the production process for a long period of time.

(v) Terms of credit for buying and selling goods, discount allowed by suppliers and to the customers also determines the quantum of working capital.