NCERT Solutions For Class 11 Business Studies Small Business

TEXTBOOK QUESTIONS SOLVED

I. Short Answer Type Questions

Question 1. What are the different parameters used to measure the size of business?

Answer: Following parameters may be used to measure the size of business:

(a) Number of workers employed (b) Size of plant and machinery

(c) Total output (d) Inventory size

Question 2. What is the definition used by government of India for Small Scale Industries?

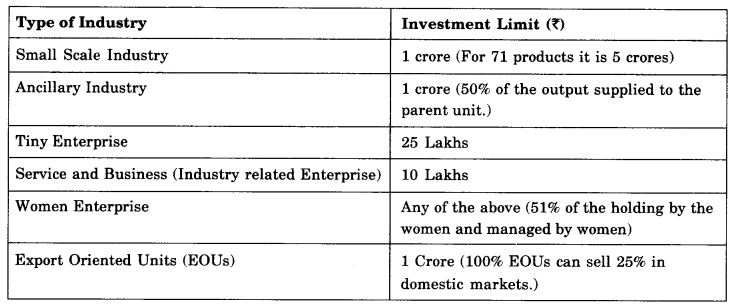

Answer: Government uses the criterion of size of capital employed in plant and machinery to define Small Scale Industries. It is depicted in the table given below:

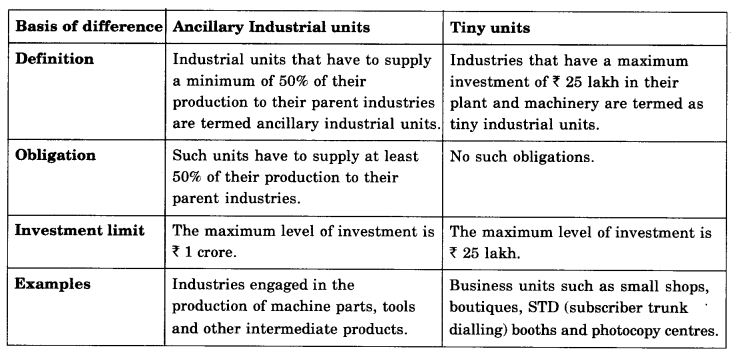

Question 3. How would you differentiate between an ancillary unit and a tiny unit?

Answer:

Question 4. State the features of cottage industries.

Answer: The following are a few important features of cottage industries.

- Ownership: These are rural-based industries owned and operated by individuals who invest their private resources in these units.

- Level of capital and production techniques: The amount of capital is very small, and the production techniques are highly labour-intensive and indigenous.

- Employment: These industries generally do not hire labour but employ the owners family members.

- Talent and skills: Usually, the talent and the skills required for cottage industries are found restricted to particular families. The skills are passed on from one generation to the next. For instance, the art of pottery remains restricted to potter families.

- Market: Although the production is primarily carried out for self-consumption, a portion of the output is sold in the local market as well.

II. Long Answer Type Questions

Question 1. How do small scale industries contribute to the socio-economic development of India?

Answer: Small-scale industries (SSIs) play an important role in ensuring the progress of

developing countries such as India. The following points highlight their contribution.

- Market Share: SSIs make up 95 per cent of the industrial units in India. They contribute about 40 percent of the ‘gross industrial value added’ and 45 per cent of India’s total exports.

- Regional Balance: SSIs produce simple products and use basic technology. In addition, these industries do not require heavy capital investment, and therefore, they can be set up by anyone anywhere across the country. Small units not only benefit the particular region where it is established but also help reduce the regional disparities in industrial development among different regions of a country.

- Employment Generation: As SSIs use labour-intensive production techniques, they have a greater employment generation potential than large industries. Moreover, the skills required to perform jobs in SSIs are usually not very specific, which further increases their scope for generating employment.

- Wide range of Products: Small scale units produce a large variety of consumer products, such as stationery items, safety matches, handicrafts, vegetables and processed food. Besides, SSIs also produce a few items by using technology, such as calculators, televisions and engineering goods.

- Customized Goods: Small industrial units adapt perfectly to specific needs of consumers. As SSIs use simple and highly flexible production techniques, they can provide their customers with goods best suited to the customers tastes and preferences.

Question 2. Describe the role of small business in rural India?

Answer: The following are some of the major roles played by small scale businesses in rural

India.

- They generate employment opportunities: Cottage and rural industries play a significant role in providing employment opportunities, particularly to people in rural areas. This proves to be a boon especially for the economically weaker sections of the rural society.

- They enable equitable income distribution: The capital requirements of small- scale businesses are low, mainly because of their use of labour-intensive production techniques, and this encourages entrepreneurs to start units on a small scale. Small- scale businesses are, therefore, set up all over the country. Many of them providing employment opportunities to people in rural areas. This triggers the redistribution of wealth and income, and enables the equitable distribution of income in rural areas.

- They help to accelerate growth: Small-scale businesses have been considered as a major propeller for the acceleration of economic growth and as an employment generator, particularly in the rural and backward areas of India.

- They mitigate disguised unemployment and alleviate poverty: Small-scale businesses use labour-intensive production techniques, and are, therefore, able to provide employment to the excess/surplus rural labour. Thus, small-scale businesses remove disguised unemployment from the agriculture sector and at the same time provide livelihood to the rural people. Hence, they contribute to alleviating rural poverty.

- They facilitate rural development and reduce migration from rural to urban areas: It is well known that a large number of people migrate from rural to urban areas in search of better employment opportunities and improved living standards. Small-scale businesses help reduce this migration by providing employment opportunities to rural people in their own regions. By doing so, small units also help mitigate the excessive pressure on urban infrastructure.

Question 3. Discuss the problems faced by small scale industries.

Answer: Major problems faced by the small scale industries are: (1) Finance (2) Raw material

(3) Idle capacity (4) Technology (5) Marketing (6) Infrastructure (7) Under Utilization of Capacity (8) Project Planning.

Small scale industries play a vital role in the economic development of our country. This sector can stimulate economic activity and is entrusted with the responsibility of realising various objectives i.e., generation of more employment opportunities with less investment, reducing regional imbalances etc. Small scale industries are not in a position to play their role effectively due to various constraints. The various constraints, the various problems faced by small scale industries are as under:

- Finance: Finance is one of the most important problems confronting small scale industries. Finance is the life blood of an organisation and no organisation can function properly in the absence of adequate funds. The scarcity of capital and inadequate availability of credit facilities are the major causes of this problem. Firstly, adequate funds are not available and secondly, entrepreneurs due to weak economic base, have lower credit worthiness. Neither they are having their own resources nor are others prepared to lend them. Entrepreneurs are forced to borrow money from money lenders at exorbitant rate of interest and this upsets all their calculations.

After nationalisation, banks have started financing this sector. These enterprises are still struggling with the problem of inadequate availability of high cost funds. These enterprises are promoting various social objectives and in order to facilitate them working adequate credit on easier terms and conditions must be provided to them. - Raw Material: Small scale industries normally tap local sources for meeting raw material requirements. These units have to face numerous problems like availability of inadequate quantity, poor quality and even supply of raw material is not on regular basis. All these factors adversely affect the functioning of these units.

Large scale units, because of more resources, normally comer whatever raw material is available in the open market. Small scale units are thus forced to purchase the same raw material from the open market at very high prices. It will lead to increase in the cost of production thereby making their functioning unavailable. - Idle Capacity: There is under utilization of installed capacity to the extent of 40 to 50 per cent in case of small scale industries. Various causes of this under utilization are shortage of raw material problem associated with funds and even availability of power. Small scale units are not fully equipped to overcome all these problems as is the case with the rivals in the large scale sector.

- Technology: Small scale entrepreneurs are not fully exposed to the latest technology. Moreover, they lack requisite resources to update or modernise their plant and machinery Due to obsolete methods of production, they are confronted with the problems of less production in inferior quality and that too at higher cost. They are in no position to compete with their better equipped rivals operating modem large scale units.

- Marketing: These small scale units are also exposed to marketing problems. They are not in a position to get first hand information about the market i.e., about the competition, taste, liking, disliking of the consumers and prevalent fashion.

With the result they are not in a position to upgrade their products keeping in mind market requirements. They are producing less of inferior quality and that too at higher costs. Therefore, in competition with better equipped large scale units they are placed in a relatively disadvantageous position.

In order to safeguard the interests of small scale enterprises the Government of India has reserved certain items for exclusive production in the small scale sector. Various government agencies like Trade Fair Authority of India, State Trading Corporation and the National Small Industries Corporation are extending helping hand to small scale sector in selling its products both in the domestic and export markets. - Infrastructure: Infrastructure aspects adversely affect the functioning of small scale units. There is inadequate availability of transportation, communication, power and other facilities in the backward areas. Entrepreneurs are faced with the problem of getting power connections and even when they are lucky enough to get these they are exposed to unscheduled long power cuts.

Inadequate and inappropriate transportation and communication network will make the working of various units all the more difficult. All these factors are going to adversely affect the quantity, quality and production schedule of the enterprises operating in these areas. Thus their operations will become uneconomical and unviable. - Under Utilization of Capacity: Most of the small-scale units are working below full potentials or there is gross under utilization of capacities. Large scale units are working for 24 hours a day i.e., in three shifts of 8 hours each and are thus making best possible use of their machinery and equipment’s.

On the other hand, small scale units are making only 40 to 50 percent use of their installed capacities. Various reasons attributed to this gross under utilization of capacities are problems of finance, raw material, power and underdeveloped markets for their products - Project Planning: Another important problem faced by small scale entrepreneurs is poor project planning. These entrepreneurs do not attach much significance to viability studies i.e., both technical and economical and plunge into entrepreneurial activity out of mere enthusiasm and excitement.

They do not bother to study the demand aspect, marketing problems, and sources of raw materials and even availability of proper infrastructure before starting their enterprises. Project feasibility analysis covering all these aspects in addition to technical and financial viability of the projects, is not at all given due weight age. Inexperienced and incomplete documents which invariably results in delays in completing promotional formalities. Small entrepreneurs often submit unrealistic feasibility reports and incompetent entrepreneurs do not fully understand project details.

Moreover, due to limited financial resources they cannot afford to avail services of project consultants. This results in poor project planning and execution. - Skilled Manpower: A small scale unit located in a remote backward area may not have problem with respect to unskilled workers, but skilled workers are not available there. Firstly, skilled workers may be reluctant to work in these areas and secondly, the enterprise may not afford to pay the wages and other facilities demanded by these workers.

Besides non-availability of entrepreneurs are confronted with various other problems like absenteeism, high labour turnover indiscipline, strike etc. These labour related problems result in lower productivity, deterioration of quality, increase in wastages, and rise in other overhead costs and finally adverse impact on the profitability of these small scale units. - Managerial: Managerial inadequacies pose another serious problem for small scale emits. Modem business demands vision, knowledge, skill, aptitude and whole hearted devotion. Competence of the entrepreneur is vital for the success of any venture. An entrepreneur is a pivot around whom the entire enterprise revolves.

Many small scale units have turned sick due to lack of managerial competence on the part of entrepreneurs. An entrepreneur who is required to undergo training and counseling for developing his managerial skills will add to the problems of entrepreneurs.

Of course, increase in number of units, production, employment and exports of small- scale industries over the years are considered essential for the economic growth and development of the country. It is encouraging to mention that the small-scale enterprises accounts for 35% of the gross value of the output in the manufacturing sector, about 80% of the total industrial employment and about 40% of total export of the country.

Question 4. What measures have the Government taken to solve the problem of finance and marketing in the small scale sector?

Answer: Indian Government created two ministries to promote and develop small scale industries:

- Ministry of Small Scale Industries. Ministry of Small Scale Industries designs policies, programmes and schemes to promote small scale industries. Small Industries Development Organization (SIDO) is responsible for implementing and monitoring of various policies and progammes formulated by the ministry.

- Ministry of Agro and Rural Industries is a nodal agency for coordination and development of village and khadi industries, tiny and micro enterprises in urban as well as rural areas. Its policies are implemented through Khadi and Village Industries Commission (KVIC), Handicrafts Board, Coir Board etc.

The small-scale sector has played a major role in employment generation, regional development and export promotion in India. The Government of India has realized that a lot more can be achieved if the two major bottlenecks that affect the further development of SSIs—inadequate funds and inefficient market penetration—are removed. In pursuit of this objective, the government has established the following agencies.

- National Bank for Agriculture and Rural Development (NABARD): It was established in 1982 with the main objective of promoting rural development and integrating the efforts in this direction. This agency is an apex banking body that governs the operations particularly of the rural and ‘Gramm’ banks. The main focus of NABARD is to provide cheap and easy credit facility to small, cottage and rural industries.

- Small Industries Development Bank of India (SIDBI): It was set up to provide direct and indirect financial assistance under different schemes. It caters to the credit and finance requirements of small-scale enterprises.

- World Association for Small and Medium Enterprises (WASME): It is an international non-governmental organisation that addresses the problems of small and medium-scale enterprises. It has set up an ‘International Committee for Rural Industrialisation’ with the aim of designing a model for the growth and development of rural industries.

- The National Commission for Enterprises in the Unorganised Sector (NCEUS): It was formed in September 2004 with the objective of improving the efficiency and enhancing the global competitiveness of small scale industries. It focuses on addressing the problems faced by small enterprises, particularly in the unorganised/informal sector.

- Various Development and Employment Generation Programmes: Besides establishing the organisations mentioned above, the government has launched various programmes for rural development. Among the important programmes are the Prime Minister’s Rozgar Yojana (PMRY), Integrated Rural Development Programme (IRDP) and Training of Rural Youth for Self-Employment (TRYSEM). These programmes are aimed at generating greater employment opportunities, developing rural areas and making the rural people self-reliant.

Question 5. What are the incentives provided by the government for industries in backward and hilly areas?

Answer: It is quite lucrative and feasible for entrepreneurs to establish industries in metropolitan and other developed cities. However, because of numerous factors such as irregular power supply, poor transport and absence of banking facilities, it is extremely difficult for them to set up industries in backward, hilly and tribal areas. As a result, there exists acute regional disparities in development between these areas and the big cities in the country. The Government of India has been making efforts to remove the regional imbalances in development by providing incentives for setting up industries in rural areas. The following are among the incentives offered.

- Land: It is a basic requirement for setting up a business unit. In order to encourage the establishment of industries in backward areas, the government provides land plots at concessional rates, especially to industrialists in backward regions. This makes setting-up industries cheaper.

- Power: Power is an essential requirement for the functioning of business enterprises. However, its supply is highly irregular in some parts of India. Therefore, in order to facilitate the setting up of industries in these areas, electricity is supplied at a discounted rate of 50 per cent. In addition, some states exempt such units from any payment during the initial years of operation.

- Banking and finance: Due to the poor banking facilities, industries set up in the backward areas face the problem of inadequate credit and finance. As a solution, the government provides loans at a concessional rate and offers subsidies of 10 to 15 per cent for the accumulation of capital assets.

- Raw Materials: Resources such as cement, iron and steel are of prime importance for industries. Since these resources are scarce, the government provides them on priority basis to industries located in backward areas.

- Tax Exemption: In order to attract entrepreneurs to set up industries in the backward areas, different state governments grant tax exemption to the industries. Thus, the industries are exempted from paying taxes for 5 to 10 years.

MORE QUESTIONS SOLVED

I. Very Short Answer Type Questions

Question 1. Name any two institutions specially set up to promote small scale enterprises.

Answer: SIDBI and SIDO

Question 2. Give full from of SIDBI .

Answer: Small Industries Development Bank of India

Question 3. Give full from of NABARD.

Answer: National Bank for Agriculture and Rural Development

Question 4. Give one feature of Cottage Industries.

Answer: These are rural-based industries owned and operated by individuals who invest their private resources in these units.

Question 5. Give any two incentives offered by the Government to small scale industries.

Answer: (a) Land: In order to encourage the establishment of industries in backward areas, the government provides land plots at concessional rates, especially to industrialists in backward regions.

(b) Power: Power is an essential requirement for the functioning of business enterprises.

Question 6. What is the investment limit for SSI?

Answer: Rs. One crore (Rs 5 crore for specified 71 products)

Question 7. Give any two problems faced by SSI.

Answer: Obsolete technology and lack of marketing facilities

Question 8. Discuss any two characteristics of SSI.

Answer:

- They are run as sole proprietorship or partnership.

- Normally they use labour intensive methods.

Question 9. Name the institution which was set up in 1982 to promote integrated rural development.

Answer: National Bank for Agriculture and Rural Development

Question 10. Name any two units included in SSI category.

Answer: Export oriented units and Ancillary units

Question 11. What is the role of National Small Industries Corporation for the growth of small business units in India?

Answer: It promotes, provides aid and fosters the growth of small business units in the country. This focuses on the commercial aspects of these functions.

Question 12. Name the apex bank set up to provide direct and indirect financial assistance to small scale sector.

Answer: Small Industries Development Bank of India

Question.13. What is the role of District Industries Centre for the growth of small business in India?

Answer. District Industries Centers programme was launched on May 1, 1978 with a view to providing an integrated administrative framework at the district level which looks at the problem of industrialisation in the district.

Question 14. How much do small industries in India account for the total industrial units?

Answer: 95%

Question 15. What is the parameter used by the government to identify service enterprise?

Answer: An industry is a micro enterprise if investment in equipment does not exceed Rs 10 lakhs. An industry is a small enterprise if investment in equipment is more than Rs 10 lakhs but does not exceed Rs 2 crore. An industry is a medium enterprise if investment in equipment is more than Rs 2 crore but does not exceed Rs 5 crore.

II. Short Answer Type Questions

Question 1. Small business is business at small scale. Do you agree? Explain.

Answer: Yes, I agree. Scale of operations can be measured in terms of workers employed, capital invested or total output. Indian Government considers the criterion of capital invested in plant and machinery. Accordingly a business in which investment in plant and machinery is less than 1 core comes under small scale business.

Question 2. Write a short note on village and small industries sector.

Answer: In India Village and small industries sector’ consists of traditional as well as modern small industries. It has eight sub-groups Handlooms, Handicrafts, Coir, Sericulture, Khadi Industries, Village Industries, Small Scale Industries and Power looms. Small industries and power looms come in the category of modem industries and rest are included under traditional industries. Village and small industries together provide the largest employment opportunities in India.

Question 3. What is the purpose of NABARD?

Answer: The main functions of NABARD pertain to policy development, coordination, research, training, etc., relating to rural credit. It provides refinance to cooperatives, regional rural banks, etc. Moreover it makes loans and advances to state governments for a period not exceeding more than 20 years to enable them to subscribe directly or indirectly to share the capital of cooperative credit societies.

It also promotes research in agriculture and rural development through its research and development fund. It undertakes inspection of co-operative banks and RRBs and advises the government on related matters. NABARD undertakes monitoring and evolution of the projects financed by it. The NABARD maintains two funds; The National Rural Credit Fund (long-term operations) and the National Rural Credit Fund (Stabilization).

The central and state governments contribute to the fund. The NABARD operates throughout the country through its 16 regional offices located in the capitals of all the major states and 3 sub offices, the paid-up capital of NABARD stood at Rs 2000 crore as on March 31, 2010. The profit after tax amounted to Rs 1558 crore during the year 2009-10 as against Rs 1390 crore during the year 2008-09.

NABARD had a paid-up share capital of Rs 100 crore, since this has been raised through stages to Rs 5,000 crore. The NABARD is empowered to borrow from central government.

It is also permitted to borrow foreign currency. It can also borrow long-term loans from any other authority or organisation or institution approved by the Board. It is empowered to issue bonds, debentures and other financial instruments.

Question 4. Explain the role of SIDBI in promoting small scale enterprises.

Answer: Small Industries Development Bank of India (SIDBI). was set up on April 2, 1990 under an Act of Indian Parliament, is the principal financial institution for the promotion, financing and development of the Micro, Small and Medium Enterprise (MSME) sectors and for co-ordination of the functions of the institutions engaged in similar activities.

Financial support is provided by way of refinance to eligible Primary Lending Institutions (PLIs) such as banks, State Financial Corporations (SFCs), State Industrial Development Corporations (SIDCs), State Small Industries Development Corporations (SSIDCs) etc. for onward lending to MSMEs, financial assistance in the form of loans, grants, equity and quasi-equity to Non Government Organisations (NGOs) / Micro Finance Institutions (MFIs) for onlending to micro enterprises and economically weaker sections of society, enabling them to take up income generating activities on a sustainable basis and direct assistance to MSMEs which is channelised through the bank’s network of 130 branch offices.

While finance is the basic need of the MSMEs, they also require different non-credit facilities to gain the extra mile in their endeavour to attain international competitiveness. Such requirements are equity capital, credit rating, technology transfer and upgradation, etc. SIDBI has been constantly working on building various institutional mechanisms to cater to the emerging needs of the MSME sector and has set-up various subsidiaries/associates viz.

SIDBI Venture Capital Ltd. (SVCL) is a subsidiary of SIDBI. It was set up in July,1999. It is an asset management company, presently managing two venture capital funds. Credit Guarantee Fund Trust for Micro and Small Enterprises (CGFTMSE) in July 2000 by Government of India and SIDBI, to provide credit guarantee support to collateral-free/third-party guarantee free loans extended by banks and lending institutions for micro and small enterprises (MSEs);

SME Rating Agency of India Ltd. (SMERA) was set up in September 2005, as an MSME dedicated third-party rating agency to provide comprehensive, transparent and reliable ratings and risk profiling.

India SME Technology Services Limited (ISTSL), was set up in November 2005. It provides a platform for MSMEs to tap opportunities at the global level for acquisition of modem technologies.

India SME Asset Reconstruction Company Ltd (ISARC) is the country’s first MSME focused asset reconstruction company striving for speedy resolution of non-performing assets (NPA) by unlocking the idle NPAs for productive purposes which would facilitate greater and easier flow of credit from the banking sector to the MSMEs

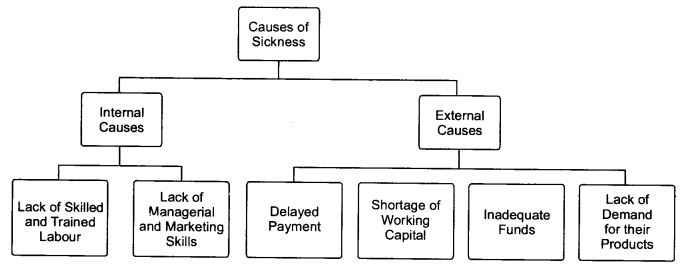

Question 5. What are the causes of sickness in small industries?

Answer: Causes of sickness in SSIs can be classified into internal as well as external categories.

Question 6. What is the difference between small scale enterprise and cottage industry?

Answer: “Small Scale Industries are located in urban centers and produce goods with partially or wholly mechanised equipment employing outside labour, small in size, having little capital resources and a small labour force”

“Cottage Industries are mainly rural in character and are generally associated with agriculture involving operations mostly by hands and are carried on in the home either as a whole time or as a part time occupation, primarily with the help of members of the family.”

Difference between the Small-Scale Industries and Cottage Industries:

The differences between the small scale and cottage industries are basically two:

- While small-scale industries are mainly located in urban centres as separate establishments, the cottage industries are generally associated with agriculture and provide subsidiary employment in rural areas.

- While small-scale industries produce goods with mechanised equipment employing outside labour, the cottage industries involve operations mostly by hand which are carried on primarily with the help of the members of the family.

Question 7. Explain the areas where small businesses feel threatened from global competition.

Answer: Given below are the areas where small businesses feel threatened from global competition:

- It is difficult to maintain quality standards, technological skills, financial credit worthiness, managerial and marketing capabilities of the large industries and MNCs.

- They have to face competition from giant sized MNCs along with medium and large scale enterprises. It brings cut throat competition for them.

- There is limited access to markets of developed countries because of stringent requirements of quality certification like ISO: 9000 etc.

Question 8. Explain the meaning of small scale industry with its different categories.

Answer: In Indian economy small-scale and cottage industries occupy an important place, because of their employment potential and their contribution to total industrial output and exports.

Government of India has taken a number of steps to promote them. However, with the recent measures, small-scale and cottage industries facing both internal competition as well as external competition.

There is no clear distinction between small-scale and cottage industries. However it is generally believed that cottage industry is one which is carried on wholly or primarily with the help of the members of the family. As against this, small-scale industry employs hired labour.

Moreover industries are generally associated with agriculture and provide subsidiary employment in rural areas. As against this, small scale units are mainly located in urban areas as separate establishments.

Definition: Small scale industry is defined as a unit in which investment in original value of plant and machinery should not exceed Rs 1.5 crore.

However, to facilitate technology upgradation and enhance competitiveness, the investment limit has been raised to Rs 5 crore in respect of 71 high tech export oriented items in drugs, pharmaceuticals, hand-tools and knitwear sectors, etc.

Different categories include:

- Micro and tiny industries

- Women enterprises

- Cottage industries

- Village industries

Question 9. List out major industry groups in the small sector in India.

Answer: The official definitions of the small scale unit are as follows:

- Small-Scale Industries:

These are the industrial undertakings having fixed investment in plant and machinery, whether held on ownership basis or lease basis or hire purchase basis not exceeding Rs 1 crore. - Ancillary Industries:

These are industrial undertakings having fixed investment in plant and machinery not exceeding Rs 1 crore engaged in or proposed to engage in,

(a) The manufacture of parts, components, sub-assemblies, tooling or intermediaries, or

(b) The rendering of services supplying 30 per cent of their production or services as the case may be, to other units for production of other articles. - Tiny Units:

These refer to undertakings having fixed investment in plant and machinery not exceeding Rs 23 lakhs. These also include undertakings providing services such as laundry, xeroxing, repairs and maintenance of customer equipment and machinery, hatching and poultry etc. located m towns with population less than 50,000 - Small-Scale Service Establishments:

These mean enterprises engaged in personal or household services in rural areas and town with population not exceeding 50000 and having fixed investment in plant and machinery not exceeding Rs 25 lakhs. - Household Industries:

These cover artisans, skilled craftsman and technicians who can work in their own houses if their work requires less than 300 square feet space, less than 1 Kw power, less than 5 workers and no pollution is caused. Handicrafts, toys, dolls, small plastic and paper products, electronic and electrical gadgets are some of the examples of these industries.

Question 10. State the objectives of small business in rural India.

Answer: The objectives of small scale industries are follows:

- To create more employment opportunities with less investment.

- To remove economic backwardness of rural and less developed regions of the economy.

- To reduce regional imbalances.

- To mobilize and ensure optimum utilization of unexploited resources of the country.

- To improve standard of living of people.

- To ensure equitable distribution of income and wealth.

- To solve unemployment problem.

- To attain self-reliance.

- To adopt latest technology aimed at producing better quality products at lower costs.

Question 11. What are the measures taken by the Government to solve the problem of finance in the small scale sector?

Answer: Following Measures have been taken by the government to solve the problem of finance in small scale sector:

- Small Industries Development Bank of India (SIDBI): It was set up on April 2, 1990 under an Act of Indian Parliament, is the principal financial institution for the promotion, financing and development of the Micro, Small and Medium Enterprise (MSME) sector and for coordination of the functions of the institutions engaged in similar activities.

Financial support is provided by way of refinance to eligible Primary Lending Institutions (PLIs) such as banks, State Financial Corporations (SFCs), State Industrial Development Corporations (SIDCs), State Small Industries Development Corporations (SSIDCs) etc. for onward lending to MSMEs, financial assistance in the form of loans, grants, equity and quasi-equity to Non Government Organisations/ Micro Finance Institutions (MFIs) for on-lending to micro enterprises and economically weaker sections of society, enabling them to take up income generating activities on a sustainable basis and direct assistance to MSMEs which is channelised through the bank’s network of 130 branch offices. - The National Commission for Enterprises in the Unorganised Sector (NCEUS): It was established by the Government of India as an advisory body on the informal sector to bring about improvement in the productivity of informal enterprises for generation of large scale employment opportunities on a sustainable basis, particularly in the rural areas. The Commission was mandated to recommend appropriate measures to enhance the competitiveness of the informal sector in the global economy and to link the sector with the institutional framework in areas such as credit, raw material, infrastructure, technology upgradation skill development, and marketing.

Question 12. Write a short note on WASME.

Answer: World Association for Small and Medium Enterprises (WASME) is a global non-governmental organization head quartered at Noida, India. It has been spearheading the cause and development of Small and Medium Enterprises (SMEs) world over since its inception in 1980. It has emerged, over the years, as one of the most representative, effective and leading international organizations, working towards the promotion of SMEs. The vision behind establishment of WASME was to build a world private community of small business, their supporting and financial institutions as a non-governmental organization, not influenced by any government(s). WASME has members, associates and network partners in different countries across the world. It enjoys consultative/observer status with concerned agencies in UN system such as ECOSOC, UNCTAD, WIPO, UNIDO, UNICITRAL, UNESCAP, ITC and ILO. It also cooperates actively with several intergovernmental and international organizations such as WCO, OECD, ICSB, APCTT, etc.

Question 13. Write a short note on SIDO.

Answer: It is the office of the Development Commissioner for Small Scale Industries. SIDO was established in 1954 on the basis of the recommendations of the Ford Foundation. It has over 60 offices and 21 autonomous bodies under its management. These autonomous bodies include Tool Rooms, Training Institutions and Project-cum-Process Development Centres.

Various services provided by SIDO to the SMEs:

- Facilities for testing, toolmenting, training for entrepreneurship development.

- Preparation of project and product profiles.

- Technical and managerial consultancy.

- Assistance for exports.

- Pollution and energy audits.

SIDO also provides economic information services and advises Government in policy formulation for the promotion and development of SSIs. The field offices also work as effective links between the central and the state governments.

Question 14. What forms of support is offered to small industries by the government?

Answer: Government offers support to small industries in the following forms:

- Institutional support in respect of credit facilities;

- Provision of developed sites for construction of sheds;

- Supply of machinery on hire purchase system;

- Technical and financial help for technical upgradation;

- Special incentives for setting up of industries in backward areas;

- Provision for training facilities;

- Assistance for domestic and export marketing.

III. Long Answer Type Questions

Question 1. What do you mean by small business? Describe the feature of small scale enterprise.

Answer: plant and machinery should not exceed Rs 1.5 crore. However, to facilitate technology upgradation and enhance competitiveness, the investment limit has been raised to Rs 5 crore in respect of 71 high tech export oriented items in drugs, pharmaceuticals, hand-tools and knitwear sectors, etc. Characteristics of Small-Scale Industries:

- Ownership: Ownership of small scale unit is with one individual in sole- proprietorship or it can be with a few individuals in partnership.

- Management and Control: A small-scale unit is normally a one man show and even in case of partnership the activities are mainly carried out by the active partner and the rest are generally sleeping partners. These units are managed in a personalized fashion. The owner is actively involved in all the decisions concerning business.

- Area of Operation: The area of operation of small units is generally localised catering to the local or regional demand. The overall resources at the disposal of small scale units are limited and as a result of this, it is forced to confine its activities to the local level.

- Technology: Small industries are fairly labour intensive with comparatively smaller capital investment than the larger units. Therefore, these units are more suited for economics where capital is scarce and there is abundant supply of labour.

- Gestation Period: Gestation period is that period after which teething problems are over and return on investment starts. Gestation period of small scale unit is less as compared to large scale unit.

- Flexibility: Small scale units as compared to large scale units are more change susceptible and highly reactive and responsive to socio-economic conditions.

They are more flexible to adopt changes like new method of production, introduction of new products etc. - Resources: Small scale units use local or indigenous resources and as such can be located anywhere subject to the availability of these resources like labour and raw materials.

- Dispersal of Units: Small scale units use local resources and can be dispersed over a wide territory. The development of small scale units in rural and backward areas promotes more balanced regional development and can prevent the influx of job seekers from rural areas to cities.

Question 2. Describe briefly the problems of small scale enterprises.

Answer: Small scale industries in India could not progress satisfactorily due to various problems that they are confronted with while running enterprises. In spite of having huge potentialities, the major problems, small industries face are given below.

- Problem of skilled manpower: The success of a small enterprise revolves around the entrepreneur and its employees, provided the employees are skilled and efficient. Because inefficient human factor and unskilled manpower create innumerable problems for the survival of small industries. Non-availability of adequate skilled manpower in the rural sector poses problem to small-scale industries.

- Inadequate Credit Assistance: Adequate and timely supply of credit facilities is an important problem faced by small-scale industries. This is partly due to scarcity of capital and partly due to weak creditworthiness of the small units in the country.

- Irregular Supply of Raw Material: Small units face severe problems in procuring the raw materials whether they use locally available raw materials or imported raw materials. The problems arise due to faulty and irregular supply of raw materials. Non-availability of sufficient quantity of raw materials, sometimes poor quality of raw materials, increased cost of raw materials, foreign exchange crisis and above all lack of knowledge of entrepreneurs regarding government policy are other few hindrances for small-scale sector.

- Absence of Organized Marketing: Another important problem faced by small- scale emits is the absence of organized marketing system. In the absence of organized marketing, their products compare unfavourably with the quality of the product of large- scale units. They also fail to get adequate information about consumer’s choice, taste and preferences of the type of product. The above problems do not allow them to stay in the market.

- Lack of Machinery and Equipment: Small-scale units are striving hard to employ modern machineries and equipment in their process of production in order to compete with large industries. Most of the small units employ outdated and traditional technology and equipment. Lack of appropriate technology and equipment create a major stumbling block for the growth of small-scale industries.

- Absence of Adequate Infrastructure: Indian economy is characterized by inadequate infrastructure which is a major problem for small units to grow. Most of the small units and industrial estates found in towns and cities are having one or more problems like lack of power supply, water and drainage problem, poor roads, raw materials and marketing problem.

Thus absence of adequate infrastructure adversely affects the quality, quantity and production schedule of the enterprises which ultimately results in under-utilization of capacity. - Competition from Large-scale Units and Imported Articles: Small-scale units find it very difficult to compete with the product of large-scale units and imported articles which are comparatively very cheap and of better quality than small units product.

- Other Problems: Besides the above problems, small-scale units have been constrained by a number of other problems also. They include poor project planning, managerial inadequacies, old and orthodox designs, high degree of obsolescence and huge number of bogus concerns. Due to all these problems the development of small- scale industries could not reach a prestigious stage.

Question 3. What incentives have been taken by government to promote small scale industries?

Answer: Many incentives are provided both by the central and state governments to promote the growth of small-scale industries and also to protect them from the onslaught of the large-scale sector. Among the various incentives given to small-scale industries the following deserve special mention:

- Reservation: To protect the small-scale industries from the competition posed by large-scale industries, the Government has reserved the production of certain items exclusively for the small-scale sector. The number of items exclusively reserved for the small-scale sector has been considerably increased during the Five Year Plan Periods and now stands at 822.

However, prior to the 1997-98 budget the number of items reserved for the small- scale sector stood at 836. The Finance Minister dereserved 14 items in the 1997-98 budget. - Preference in Government Purchases: The government as well as government Organizations shows preference in procuring their requirements from the small- scale sector. For instance, the Director General of Supplies and Disposals purchases 400 items exclusively from the small-scale sector. The National Small-Scale Industries Corporation assists the SSI units in obtaining a greater share of government and defense purchases.

- Price Preference: The SSI units are given price preference up to a maximum of 15 per cent in respect of certain items purchased both from small-scale and large- scale units.

- Supply of Raw Materials: In order to ensure regular supply of raw materials, imported components and equipment’s, the Government gives priority allocation to the small-scale sector as compared to the large-scale sector. Further, the Government has liberalised the import policy and streamlined the distribution of scarce raw materials.

- Excise Duty: In respect of SSI units excise duty concessions are granted to both registered and unregistered units on a graded scale depending upon their production value. Full exemption is granted up to a production value of Rs 30 lakhs in a year and 75 % of normal duty is levied for production value exceeding Rs 30 lakhs but not exceeding Rs 75 lakhs. If the production value exceeds Rs 75 lakhs, normal rate of duty will be levied. ‘

- RBI’s Credit Guarantee Scheme: In 1960, the RBI introduced a Credit Guarantee Scheme for small-scale industries. As per the scheme, the RBI takes upon itself the role of a guarantee organisation for the advances which are left unpaid, including interest overdue and recoverable charges. This scheme covers not only working capital but also advances provided for the creation of fixed capital.

- Financial Assistance: Small-scale industries are brought under the priority sector. As a result, financial assistance is provided to SSI units at concessional terms by commercial banks and other financial institutions. With a view to providing more financial assistance to the small scale sector, several schemes have been introduced in the recent past. The Small Industries Development Fund (SIDF) in 1986, National Equity Fund (NEF) in 1987 and the Single Window Scheme (SWS) in 1988.

SIDF provides refinance assistance to small scale and cottage and village industries and the tiny sector in rural areas. NEF provides equity type support to small entrepreneurs for setting up new projects in the tiny/small-scale sector. In 1996, the small-scale sector received 42.3 per cent of the total priority sector advances from public sector banks. - Technical Consultancy Services: The Small Industries Development Organisation, through its network of service and branch institutes, provides technical consultancy services to SSI units. In order to provide the necessary technical input to rural industries, a Council for Advancement of Rural Technology was set up in October, 1982. The Technical Consultancy Organisation renders consultancy services to SSI units at a subsidised rate. Many financial institutions are also providing subsidies to SSI units for availing of consultancy services. For instance, small entrepreneurs proposing to set up rural, cottage, tiny or small-scale units, can get consultancy services at a low cost from the Technical Consultancy Organizations approved by the All-India and State-level financial institutions.

They have to pay only 20% of the fees charged by a Technical Consultancy Organisation. The entire balance of 80% or Rs 5, 000 whichever is lower is subsidized by the Industrial Finance Corporation of India. - Machinery on Hire Purchase Basis: The National Small Industries Corporation (NSIC) arranges supply of machinery on hire purchase basis to SSI units, including ancillaries located in backward areas which qualify for investment subsidy. The rate of interest charged in respect of technically qualified persons and entrepreneurs coming from backward areas are less than the amount charged to others. The earnest money payable by technically qualified persons and entrepreneurs from backward areas is 10% as against 15% in other cases.

- Transport Subsidy: The Transport Subsidy Scheme, 1971 envisages grant of a transport subsidy to small-scale units in selected areas to the extent of 75 % of the transport cost of raw materials which are brought into and finished goods which are taken out of the selected areas.

- Training Facilities: The Entrepreneurship Development Institute of India, Financial Institutions, Commercial banks, Technical Consultancy organizations, and NSIC provide training to existing and potential entrepreneurs.

- Marketing Assistance: The National Small Industries Corporation (NSIC), the Small Industries Development Organisation (SIDO) and the various Export Promotion Councils help SSI emits in marketing their products in the domestic as well as foreign markets. The SIDO conducts training programmes on export marketing and organises meetings and seminars on export promotion.

- District Industries Centers (DICs): The 1977 Industrial Policy Statement introduced the concept of DICs. Accordingly a DIC is set up in each district. The DIC provides and arranges a package of assistance and facilities for credit guidance, supply of raw materials, marketing etc.

Question 4. Describe the scope of small business in India.

Answer: In most of the developing countries like India, Small Scale Industries (SSI) constitute an important and crucial segment of the industrial sector. They play an important role in employment creation, resource utilisation and income generation and helping to promote changes in a gradual and phased manner. They have been given an important place in the framework of Indian planning since beginning both for economic and ideological reasons. The reasons are obvious.

The scarcity of capital in India severely limits the number of non-farm jobs that can be created because investment costs per job are high in large and medium industries. An effective development policy has to attempt to increase the use of labour, relative to capital to the extent that it is economically efficient.

Small Scale Enterprises are generally more labour intensive than larger organisations. As a matter of fact, small scale sector has now emerged as a dynamic and vibrant sector for the Indian economy in recent years. It has attracted so much attention not only from industrial planners and economists but also from sociologists, administrators and politicians.

Scope of Small Scale Industry:

Defining small scale industry is a difficult task because the definition of small scale industry varies from country to country and from one time to the another in the same country depending upon the pattern and stage of development, government policy and administrative set up of the particular country.

Every country has set its own parameters in defining small scale sector. Generally, small scale sector is defined in terms of investment ceilings on the original value of the installed plant and machinery. But in the earlier times the definition was based on employment. In the Indian context, the parameter are as follows.

The Fiscal Commission, Government of India, New Delhi, 1950, for the first time defined a small-scale industry as, one which is operated mainly with hired labour usually 10 to 50 hands.

Fixed capital investment in a unit has also been adopted as the other criteria to make a distinction between small scale and large-scale industries. This limit is being continuously raised upwards by Government.

The Small Scale Industries Board in 1955 defined, “Small-scale industry as a unit employing less than 50 employees if using power and less than 100 employees if not using power and with a capital asset not exceeding Rs 5 lakhs”.

‘The initial capital investment of Rs 5 lakhs has been changed to Rs 10 lakhs for small industries and Rs 15 lakhs for ancillaries in 1975. Again this fixed capital investment limit was raised to Rs 15 lakhs for small units and Rs 20 lakhs for ancillary units in 1980. The Government of India in 1985, has further increased the investment limit to Rs 35 lakhs for small-scale units and 45 lakhs for ancillary units.

Again the new Industrial Policy in 1991, raised the investment ceilings in plant an machinery to ? 60 lakhs for small-scale units and Rs 75 lakhs for ancillary units.

As per the Abid Hussain Committee’s recommendations on small scale industry, the Government of India has, in March 1997 further raised investment ceilings to Rs 3 crores for small-scale and ancillary industries and to Rs 50 lakhs for tiny industry. The new policy initiatives in 1999-2000 defined small-scale industry as a unit engaged in manufacturing, repairing, processing and preservation of goods having investment in plant and machinery at an original cost not exceeding Rs 100 lakhs.

In case of tiny units, the cost limitation is up to Rs 5 lakhs. Again, the Government of India in its budget for 2007-08 has raised the investment limit in plant and machinery of small-scale industries to Rs 1.5 crores. An ancillary unit is one which is engaged or proposed to be engaged in the manufacture of production of parts, components, sub-assemblies, tooling or intermediaries or rendering services and the undertaking supplies or renders or proposes to supply or render not less than 50% of its production or services, as the case may be, to one or more other industries undertakings and whose investment in fixed assets in plant and machinery whether held on ownership terms or lease or on hire purchase does not exceed Rs 75 lakhs.

For small-scale industries, the Planning Commission of India uses terms ‘village and small scale industries’. These include modern small-scale industry and the traditional cottage and household industry.

Question 5. Highlight the role of the small business in promoting economic growth and solving other socio-economic problems.

Answer: In a developing country like India, the role and importance of small-scale industries is very significant towards poverty eradication, employment generation, rural development and creating regional balance in promotion and growth of various development activities.

It is estimated that this sector has been contributing about 40% of the gross value of output produced in the manufacturing sector and the generation of employment by the small scale sector is more than five times to that of the large-scale sector.

This clearly shows the importance of small-scale industries in the economic development of the country. The small-scale industry has been playing an important role in the growth process of Indian economy since independence in spite of stiff1 competition from the large sector and not very encouraging support from the government.

The following are some of the important role played by small scale industries in India.

- Employment Generation: The basic problem that is confronting the Indian economy is increasing pressure of population on the land and the need to create massive employment opportunities. This problem is solved to larger extent by small- scale industries because small scale industries are labour intensive in character. They generate huge number of employment opportunities. Employment generation by this sector has shown a phenomenal growth. It is a powerful tool of job creation.

- Mobilisation of resources and entrepreneurial skill: Small-scale industries can mobilize a good amount of savings and entrepreneurial skill from rural and semi- urban areas remain untouched from the clutches of large industries and put them into productive use by investing in small-scale units. Small entrepreneurs also improve social welfare of a country by harnessing dormant, previously overlooked talent.

Thus, a huge amount of latent resources are being mobilised by the small-scale sector for the development of the economy. - Equitable distribution of income: Small entrepreneurs stimulate a redistribution of wealth, income and political power within societies in ways that are economically positive and without being politically disruptive.

Thus small-scale industries ensures equitable distribution of income and wealth in the Indian society which is largely characterised by more concentration of income and wealth in the organised section keeping unorganised sector undeveloped. This is mainly due to the fact that small industries are widespread as compared to large industries and are having large employment potential. - Regional dispersal of industries: There has been massive concentration of industries in a few large cities of different states of Indian union. People migrate from rural and semi urban areas to these highly developed centres in search of employment and sometimes to earn a better living which ultimately leads to many evil consequences of over-crowding, pollution, creation of slums, etc. This problem of Indian economy is better solved by small scale industries which utilize local resources and brings about dispersion of industries in the various parts of the country thus promotes balanced regional development.

- Provides opportunities for development of technology: Small scale industries have tremendous capacity to generate or absorb innovations. They provide ample opportunities for the development of technology and technology in return, creates an environment conducive to the development of small units. The entrepreneurs of small units play a strategic role in commercializing new inventions and products. It also facilitates the transfer of technology from one to the other. As a result, the economy reaps the benefit of improved technology.

- Indigenization: Small scale industries make better use of indigenous organizational and management capabilities by drawing on a pool of entrepreneurial talent that is limited in the early stages of economic development. They provide productive outlets for the enterprising independent people. They also provide a seed bed for entrepreneurial talent and a testing round for new ventures.

- Promotes exports: Small scale industries have registered a phenomenal growth in export over the years. The value of exports of products of small-scale industries has increased to Rs 393 erores in 1973-74 to Rs 71, 244 crores in 2002-03. This contributes about 35% India’s total export. Thus they help in increasing the country’s foreign exchange reserves thereby reducing the pressure on country’s balance of payment.

- Supports the growth of large industries: The small scale industries play an important role in assisting bigger industries and projects so that the planned activity of development work is timely attended. They support the growth of large industries by providing components, accessories and semi finished goods required by them. In fact, small industries can breathe vitality into the life of large industries.

- Better industrial relations: Better industrial relations between the employer and employees helps in increasing the efficiency of employees and reducing the frequency of industrial disputes. The loss of production and man days are comparatively less in small- scale industries. There is hardly any strikes and lock out in these industries due to good employee-employer relationship.

Question 6. Explain the importance of SSI in overall development of an economy. Also discuss hurdles in its route.

Answer: Role of small scale industries:

- Contribution in industrial production;

- Employment creation;

- Contribution to export;

- The same distribution of income and prosperity.

Hurdles it faces:

Small scale industries in India can’t progress satisfactorily due to various problems likely confronted with while operating enterprises. In spite of needing huge potentialities, the major problems, small industries face are given below.

- Problem associated with Skilled Manpower: The success of your small enterprise revolves about the entrepreneur and its personnel, provided the employees tend to be skilled and efficient. Because inefficient human element and unskilled manpower create innumerable problems for your survival of small companies. Non-availability of adequate skilled manpower in the rural sector poses trouble to small scale industries.

- Inadequate Credit Assistance: Adequate and timely supply of credit facilities is an important problem faced by small-scale companies. This is partly because of scarcity of capital and partly because of weak credit worthiness of the small units near you.

- Irregular Supply Associated with Raw Material: Small units face severe problems in procuring the recyclables whether they use locally available recyclables or imported raw products. The problems arise because of faulty and irregular supply of raw materials. Non-availability of Sufficient variety of raw materials, sometimes poor quality of raw materials, increased cost of recyclables, foreign exchange crisis and most importantly lack of knowledge associated with entrepreneurs regarding Government insurance policy are other few hindrances regarding small-scale sector.

- Trouble of Marketing: Another important problem confronted by small-scale units may be the absence of organized marketing system. Due to lack of organized marketing, their products compare unfavorably with the grade of the product of large- level units.

They are also not able to get adequate information with regards to consumer’s choice, taste and preferences of the kind of product. The above problems do not let them to stay out there. - Lack of Equipment: Small-scale units are striving hard to use modem machines and equipment in their process of production so that you can compete with large companies. Most of the little units employ outdated and also traditional technology and products. Lack of appropriate technology and equipment create a major stumbling block for your growth of small-scale companies.

- Absence of Ample Infrastructure: Indian economy is seen as an inadequate infrastructure which is a major problem for small units growing. Most of the little units and industrial estates found in towns and cities are having a number of problems like lack of power supply, water and drainage trouble, poor roads, raw products and marketing problem.

Thus lack of adequate infrastructure adversely affects the product quality, quantity and production schedule in the enterprises which ultimately ends up with under-utilization of capacity.

7. Rivalry from Large Scale Units and also Imported Articles: Small-scale units still find it very difficult to contend with the product of large-scale units and imported articles that are comparatively very cheap and also of better quality compared to small units product.

Question 7. Name the institutions and banks set up to promote small scale industries in rural, backward and hilly areas. Explain their objectives.

Answer: Small Scale Industry (SSI) is an industrial undertaking in which the investment in fixed assets in plant and machinery, whether held on ownership term or on lease or hire purchase, does not exceed Rs 1 crore. However, this investment limit is varied by the Government from time to time.

Entrepreneurs in small scale sector are normally not required to obtain a license either from the Central Government or the State Government for setting up units in any part of the country. Registration of a small scale unit is also not compulsory. But its registration with the State Directorate or Commissioner of Industries or DIC’s makes the unit eligible for availing different types of Government assistance like financial assistance from the Department of Industries, medium and long term loans from State Financial Corporations and other Commercial Banks, machinery on hire- purchase basis from the National Small Industries Corporation,etc. Registration is also an essential requirement for getting benefits of special schemes for promotion of SSI viz. Credit Guarantee Scheme, Capital subsidy, Reduced custom duty on selected items, ISO-9000 Certification reimbursement and several other benefits provided by the state government.

- The Ministry of Micro, Small and Medium Enterprises acts as the nodal agency for growth and development of SSIs in the country. The ministry formulates and implements policies and programmes in order to promote small scale industries and enhance their competitiveness. It is assisted by various public sector enterprises like:-

(a) Small Industry Development Organisation (SIDO) is the apex body for assisting the Government in formulating and overseeing the implementation of its policies and programmes/projects/schemes.

(b) National Small Industries Corporation Ltd (NSIC) was established by the Government with a view to promoting, aiding and fostering the growth of SSI in the country, with focus on commercial aspects of their operation.

(c) The Ministry has established three National Entrepreneurship Development Institutes which are engaged in development of training modules, undertaking research and training and providing consultancy services for entrepreneurship development in the SSI sector. These are

(i) National Institute of Small Industry Extension Training (NISIET) at Hyderabad, National Institute of Entrepreneurship and Small Business Development (NIESBUD) at NOIDA.

(ii) Indian Institute of Entrepreneurship (HE) at Guwahati. - The National Commission for Enterprises in the Unorganised Sector (NCEUS) has been constituted with the mandate to examine the problems of enterprises in the unorganised sector and suggest measures to overcome them.

- Small Industries Development Bank of India (SIDBI) acts as apex institution for financing SSIs through various credit schemes.

IV. Higher Order Thinking Skills (HOTS)

Question 1. “The path of small scale industries is full of hurdles”. Discuss.

Answer: Yes, it is absolutely correct to say that path of SSI is full of hurdles. The following

are the major problems faced by Small Scale Industries (SSIs) in India.

- Inadequate Finance and Credit: The SSIs have always faced the problem of inadequate finance and credit. This is partly because of the scarcity of capital available with the entrepreneurs in the sector and partly because of their lack of assets for offering as collateral/mortgage to secure bank loans. As a result, these businesses have to rely on local financial resources and moneylenders’ for funds.

- Problem of Procuring Raw Materials: Due to inadequate finance and credit, SSIs face a shortage of funds for procuring raw materials and for carrying out their day-to-day business activities. In addition, the poor transportation system and the faulty supply mechanism often result in irregular supply of raw materials. For these reasons, SSIs face a severe shortage of raw materials, which hinders their smooth functioning.

- Lack of Skilled Labour: As SSIs cannot afford to pay high salaries to their employees, they usually employ semi-skilled or unskilled labourers. Hence, they face lack of skilled and talented manpower, which adversely affects their efficiency.

- Marketing: Efficient systems for marketing and promoting products have remained an unfulfilled dream of small scale industries. The main reason is the shortage of funds. Because of the lack of efficient marketing systems, small units are forced to sell their products in the markets through the middlemen, which further leads to the exploitation of the small scale entrepreneurs.

- Obsolete/outdated technology: Many small-scale industries use production techniques which are outdated and obsolete. This lowers their productivity and makes their operations unfeasible.

Question.2. What are the marketing problems faced by Small Scale Industries?

Answer: Small scale units are exposed to numerous problems. Major problems faced by these units are concerned with raw-material, labour, finance and marketing. Problem of marketing is more complicated in case of small scale industries. These units are in no position to face the onslaught of large scale limits i.e., quantity, quality and cost and at the same time are not in a position to assess the prevailing market scenario (or) changes which are taking place with respect to tastes, liking, disliking, competition, technology etc. Moreover these units do not possess the requisite expertise to adjust their operations according to the changed situation.

- Problem of Standardization: Small scale emits face problems with respect to fixing the standards and sticking. This results in the poor quality of their products and it adversely affects their image (or) goodwill in the market.

- Competition from Large Scale Units: Small scale units are ill equipped to face competition from large scale units’ with respect to quantity, quality and cost. In the modern competitive world there is survival of the fittest, even the existence of small scale units is endangered.

- Poor Sale Promotion: Small scale units have limited financial resources and hence, cannot afford to spend more on sales promotion. These units are not having any standard brand name under which they can sell their products. Various channel members try to exploit them because of the lack of goodwill of their products in the market.

- Poor Bargaining Power: Due to limited resources and lower scale of operations small scale units are in a weak position while negotiating with the suppliers of raw- material, finances (or) marketing agencies. They are always at the receiving end and as such are not in a position to safeguard their interests.

Question 3. Explain the future of small scale enterprises in the light of policy of LPG.

Answer: Present time is the time of WTO. India is a founder member of WTO. Therefore, it is bound to open its economy for the global producers. As new giant scale MNCs enters the market, it becomes must for them to steadily re-orient themselves to face the challenges coming from increased competition. Certainly competition will increase for them. In these situations the mantra of success will be “Think global and act local”.

- They need to bring dynamism, flexibility, innovative entrepreneurial spirit, small businesses need to modify themselves as per the changing needs of market driven economy.

- Government also needs to change its role from a regulator to facilitator and promoter.

- New strategies have to be found to increase partnership between large and small industries.

- In order to maintain their market share and healthy growth, SSIs need to create a level playing field for themselves.

- They will be able to compete in this global scenario if they learn to manage, adopt and improve their competitive strength.

V. Value Based Questions

Question 1. It is right on moral grounds to give some special incentives to small scale industries. Do you agree? Justify your answer.

Answer: Yes, I agree. There are many problems with SSIs. Major problems faced by the small scale industries are : (1) Finance (2) Raw Material (3) Idle Capacity (4) Technology (5) Marketing (6) Infrastructure (7) Under Utilization of Capacity (8) Project Planning. Small scale industries play a vital role in the economic development of our country. This sector can stimulate economic activity and is entrusted with the responsibility of realizing various objectives, i.e., generation of more employment opportunities with less investment; reducing regional imbalances etc. Small scale industries are not in a position to play their role effectively due to various constraints. If government provides certain incentives in the form of incentives on land, power, tax holiday etc, it can grow well and can be able to compete with large scale enterprises.

Question 2. We need to give special attention for the growth of rural, backward and hilly areas. Why?

Answer: It is rightly said that we need to give special attention for the growth of rural, backward and hilly areas because:

- Large scale business houses are unwilling to invest in these areas. It leads to lack of employment opportunities in these areas.

- There is disguised and seasonal unemployment in rural areas. This type of unemployment can best be tackled by developing small scale and village industries.

- It is the duty of the government to ensure balanced development in all corners of the country.

- It can help to make these areas developed and bring them at par with other areas of the country.