NCERT Solutions For Class 11 Business Studies International Business-II

TEXTBOOK QUESTIONS SOLVED

I. Multiple Choice Questions

Question 1. Which of the following documents are not required for obtaining an export license?

(a) IEC number

(b) Letter of credit

(c) Registration cum membership certificate id) Bank account number

Question 2. Which of the following documents is not required in connection with an import transaction?

(a) Bill of lading (b) Shipping bill

(c) Certificate of origin (d) Shipment advice

Question 3. Which of the following do not form part of duty drawback scheme?

(a) Refund of excise duties

(b) Refund of customs duties

(c) Refund of export duties

(d) Refund of income dock charges at the port of shipment

Question 4. Which one of the following is not a document related to fulfill the customs formalities?

(a) Shipping bill (6) Export license

(c) Letter of insurance (d) Performa invoice

Question 5. Which one of the following is not a part of export documents?

(a) Commercial invoice (b) Certificate of origin

(c) Bill of entry (d) Mate’s receipt

Question 6. A receipt issued by the commanding officer of the ship when the cargo is loaded on the ship is known as:

(a) Shipping receipt (b) Mate receipt

(c) Cargo receipt (d) Charter receipt

Question 7. Which of the following document is prepared by the exporter and includes details of the cargo in terms of the shippers name, the number of packages, the shipping bill, port of destination, name of the vehicle carrying the cargo?

(a) Shipping bill (b) Packaging list

(c) Mate’s receipt (d) Bill of exchange

Question 8. The document containing the guarantee of a bank to honour drafts drawn on it by an exporter is

(a) Letter of hypothetication (b) Letter of credit

(c) Bill of lading (d) Bill of exchange

Question 9. Which of the following does not belong to the World Bank group?

(a) IBRD (6) IDA

(c) MIGA (d) IMF

Question 10. TRIP is one of the WTO agreements that deal with:

(a) Trade in agriculture (b) Trade in services

(c) Trade related investment measures (d) None of these

Answers:

1. (b) 2. (a) 3. (d) 4. (d) 5. (c)

6. (b) 7. (a) 8. (b) 9. (d) 10. (d)

II. Short Answer Type Questions

Question 1. Discuss the formalities involved in getting an export license.

Answer: Before exporting goods, it is mandatory for exporters and export firms to fulfill the legal formalities, including securing an export license. The following are the formalities to obtain an export license.

- Bank account number: An exporter must open an account in a bank authorised by the Reserve Bank of India and get an account number.

- IEC code: An export firm must obtain an IEC (Importer Exporter Code) from the Directorate General for Foreign Trade (DGFT) or the Regional Import Export Licensing Authority by submitting documents such as the exporter’s profile, prescribed certificates, two attested photographs and details of non-resident interest.

- Registration-cum-membership certificate: An export firm should get itself registered with the appropriate Export Promotion Council, such as the Engineering

Export Promotion Council (EEPC) and the Apparel Export Promotion Council (AEPC), and obtain a Registration-Cum-Membership Certificate (RCMC). - Registration with ECGC: An export firm must also get itself registered with the ECGC (Export Credit and Guarantee Corporation) in order to protect itself from any uncertainties in payments brought upon by political or commercial risks.

Question 2. Why is it necessary to get registered with an Export Promotion Council?

Answer: If a firm wants to export goods, then it must first obtain an export license. In order to obtain an export license, the firm is required to register itself with the Appropriate Export Promotion Council, such as the Engineering Export Promotion Council (EEPC) and the Apparel Export Promotion Council (AEPC). Such councils are set up by the government for promoting the export of various goods falling under their purview. O ice the registration is complete, the firm obtains the Registration-Cum-Membership Certificate (RCMC). This in turn enables it to take advantage of the benefits made available to export firms by the government. Thus, it is necessary for export firms to register themselves with an Export Promotion Council.

Question 3. What is IEC number?

Answer: An TEC number refers to the ‘Importer Exporter Code number. It is a 10-digit number granted by the Directorate General for Foreign Trade (DGFT) to an import/export firm depending upon the firm’s credibility. It is essential for an importer/ exporter to obtain this number as it is to be provided in various import/export documents. In order to obtain this number, an export or import firm submits an application to the DGFT or the Regional Import Export Licensing Authority along with documents and information such as the profile of the importer/exporter, fee receipt from a bank, non-resident’s interest details, certificate from the banker on the prescribed form, two photographs attested by the banker and a declaration about the applicant’s non-association with firms placed in the caution list. Once the final submission is done and authenticated, the DGFT or the Regional Import Export Licensing Authority issues an IEC number to the importer/exporter, which helps the firm concerned in availing itself of benefits granted by the DGFT to importers/exporters.

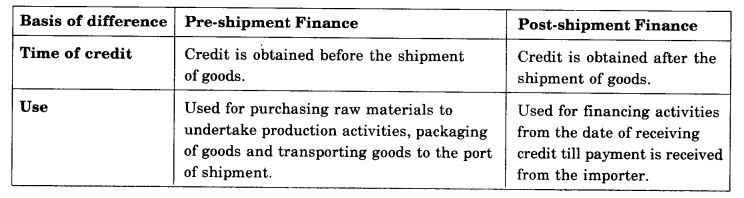

Question 4. What is pre-shipment finance?

Answer: As soon as order is confirmed and letter of credit is received, the exporter approaches the bank to receive pre-shipment finance which he needs to buy raw materials and other inputs to produce good to be exported. Firms require finance for various activities such as purchase of raw material and manufacture of goods. In the case of exporters, this finance is obtained from banks in the form of advances known as pre-shipment finance. These advances are called pre-shipment finance as they are used in operations completed before the final shipment of goods takes place. This type of credit is obtained by an exporter from his or her banker after the order has been confirmed and the letter of credit has been received from the importer. Once the bank extends credit, the exporter uses the funds to purchase raw materials to undertake production. Preshipment finance is also used for processing and packaging goods and transporting them to ports for shipment.

Question 5. Why is it necessary for an export firm to go in for pre-shipment inspection?

Answer: Pre-shipment inspection refers to the inspection of goods before their final shipment in order to ensure that only quality goods are exported. The Government has initiated measures such as compulsory inspection of certain goods by promulgating the Export Quality and Inspection Act, 1963, and designating various agencies to undertake inspection. Exporters are required to contact the Export Inspection Agency (EIA) or another designated agency and obtain an inspection certificate after getting the goods checked. However, in the case of goods exported by star trading houses, export houses, 100 per cent export-oriented units and industrial units set up in Export Processing Zones (EPZs) or Special Economic Zones (SEZs), no such inspection is required.

Question 6. Discuss the procedure related to excise clearance of goods.

Answer: Excise duty is the amount payable on raw materials used in the manufacture of goods.

Exporters are required to pay excise duty and get excise clearance. In order to get excise clearance, a manufacturer must first submit an invoice to the Regional Excise Commissioner. The Excise Commissioner then examines the invoice and, if satisfied, issues the excise clearance to the manufacturer. However, in many cases, the government may either exempt a manufacturer from payment of excise duty or refund it after payment in case the manufactured goods are meant for export. The basic objective of such exemptions is to promote the export of goods and provide a competitive market for Indian exports in the world market.

Question 7. Explain briefly the process of customs clearance of export goods.

Answer: Before the final loading of goods for export, it is necessary for the exporter to get the goods cleared by customs. This is known as Securing Customs Clearance. In this regard, an exporter first requires to submit the following documents to the customs appraiser at the Customs House:

- Shipping bill

- Export order

- Letter of credit

- Commercial invoice

- Certificate of origin

- Certificate of inspection, if necessary

- Marine insurance policy.

After the submission of the documents, a carting order is obtained from the superintendent of the port concerned. The carting order acts as a gate pass for the cargo to enter the dock as it gives the necessary instructions to the staff. The physical movement of cargo then takes place from the dock to the port area and finally the goods are stored in an appropriate storage. It may not be possible for the exporter to be present at all times for performing these formalities, and therefore the task is assigned to a Clearing and Forwarding (C and F) agent.

Question 8. What is Bill of Lading? How does it differ from bill of entry?

Answer: Bill of Lading is an essential document required at the time of an export transaction. It is issued by the shipping company as a token of acceptance that the goods have been put on board in its vessel. A Bill of Lading is an undertaking from the shipping company to transfer the goods to the port of destination. Bills of Lading are freely transferable.

In contrast, a Bill of Entry is required at the time of an import transaction. It is a form supplied by the customs office and filled by the importer once the goods are received. A Bill of Entry is submitted at the customs office with information such as the name and address of the importer, name of the ship in which the goods were transported, number of packages, marks on the package, description of imported goods, quantity and value of the imported goods, name and address of the exporter, port of destination and customs duty payable.

Question 9. What is Shipping Bill?

Answer: Shipping Bill contains information about the goods that are exported. That is, it contains particulars such as’the name of the vessel, port at which the goods are to be discharged, country of final destination and exporter’s name and address. A Shipping Bill is essential for an export transaction as it is on the basis of this document that the customs grants clearance to the export.

Question 10. Explain the meaning of Mate’s Receipt.

Answer: Mate’s Receipt is issued by the captain or commanding officer of a ship to an exporter. This receipt acts as evidence that the exporter’s cargo has been loaded on the ship. It contains information such as the name of the vessel, berth, date of shipment, condition of the cargo when it was loaded, description of the packages of the cargo, number of packages and marks on the packages. Once the port dues are received, the port superintendent gives the Mate’s Receipt to the C and F agent concerned. It is only after the Mate’s Receipt has been obtained that the shipping company will issue the bill of lading.

Question 11. What is a Letter of Credit? Why does an exporter need this document?

Answer: Letter of Credit is issued by the bank of an importer guaranteeing to honour a draft of a certain amount drawn on it by the exporter. It is an important document because, in international transactions, there is always a risk of the importer defaulting on payment once the goods are received. Thus, to minimise the risk of such defaults, the exporter often demands a letter of credit. A letter of credit enables the exporter to assess the credit worthiness of the importer. It is the most appropriate and secure method of payment for settling an international transaction.

Question 12. Discuss the process involved in securing for exports.

Answer: Once the goods for export are shipped, the importer is informed about the shipment by the exporter. However, to claim the title of the goods, the importer is required to submit various documents, such as a copy of the invoice, bill of lading, packaging list, insurance policy, certificate of origin and letter of credit. These documents are sent by the exporter and provided by the exporter’s bank only when the bill of exchange has been signed and accepted by the importer. The bill of exchange states the amount that the importer must pay to the bearer of the bill. Once the bill is received and accepted, the importer’s bank is instructed by the importer to transfer money to the exporter’s bank account.

In case the exporter wants immediate payment from his or her bank even if the payment has not been released by the importer, then he or she can secure payment by signing a letter of indemnity. This letter acts as an undertaking that the exporter will indemnify the bank, along with the accrued interest, in case of non-payment by the importer.

Last, when the exporter receives the payment from the bank, he or she obtains a bank certificate of payment. This certificate states that the necessary documents along with the bill of exchange have been presented to the importer for payment and that the payment has been received in accordance with the exchange control regulations.

Question 13. Differentiate between the following:

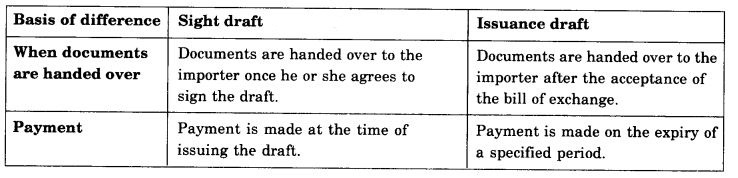

- Sight and issuance drafts,

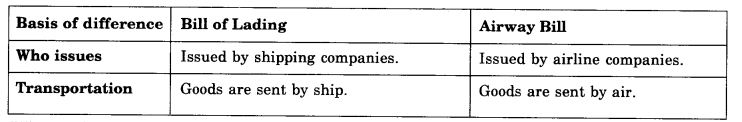

- Bill of lading and airway bill,

- Pre-shipment and post-shipment finance.

Answer:

- Sight and Issuance Draft

- Bill of Lading and Airway Bill

- Pre-shipment Finance and Post-Shipment Finance

Question 14. Explain the meaning of the following documents used in connection with import transactions

- Trade enquiry,

- Import license,

- Shipment of advice,

- Import general manifest,

- Bill of entry.

Answer:

- Trade Enquiry: It refers to a document sent by an importer to an exporter, seeking information about the price of goods, terms and conditions for supply of goods, etc.. On receipt of a trade enquiry, the exporter prepares a quotation containing the information sought, and sends it to the importer.

- Import License: An import license is issued by the Government, permitting an importer to bring in goods from outside the country. In India, for securing an import license, an importer requires an IEC (Importer Expert Code) number, which is obtained after the importer’s registration with the Directorate General for Foreign Trade (DGFT) or the Regional Import Export Licensing Authority.

- Shipment Advice: Shipment Advice is a document sent by an exporter to an importer as proof that the goods ordered have been shipped. It contains information about the bill of lading, name of the vessel, date, port of export, description of goods, etc.

- Import General Manifest: It is issued by the person in charge of the carrier (ship or airliner) in which the goods are being imported. The document informs the officer

in charge at the dock or the airport about the arrival of the goods, and it is on the basis of this document that the cargo will be unloaded. - Bill of Entry: Bill of Entry is a form supplied by the customs office and filled in by the importer at the time the goods are received. It contains information such as the name and address of the importer, name of the ship in which the goods were transported and number of packages. The importer fills in the bill form and returns it to the customs office.

Question 15. List out major affiliated bodies of the World Bank.

Answer: The following are the major affiliated bodies of the World Bank.

- IBRD: The International Bank for Reconstruction and Development (IBRD) was established in 1945 to assist in the reconstruction of war affected countries. It mainly aims at facilitating the development of the poor nations of the world.

- IFC: The IFC, or the International Finance Corporation, was formed in 1956 as a separate legal entity to provide finance to the private sector in developing nations. The IFC is part of the World Bank Group. It has its own funds and functions. It is managed independently.

- MIGA: MIGA refers to the Multinational Investment Guarantee Agency. It was established in April 1988 with the objective of encouraging foreign direct investments in the less developed countries, insuring investors against political and non¬commercial risks, providing advisory services, etc.

- IDA: The IDA, or the International Development Association, was established in 1960. Its basic objective is to provide loans and grants at concessional rates to countries whose per-capita income is very low. The loans provided by the IDA have high flexibility.

Question 16. Write short notes on the following:

- UNCTAD

- MIGA

- World Bank

- ITPO

- IMF

Answer:

- UNCTAD: The United Nation Conference on Trade and Development, or UNCTAD, was established in 1964 with the objective of integrating the developing countries with the world economy through discussions. It undertakes activities such as collecting research and data for policy making and extending technical assistance to the less developed countries as per their requirements.

- MIGA: The Multinational Investment Guarantee Agency, or MIGA, was established in April 1988 with the objective of encouraging foreign direct investment in the less developed countries. It aims at insuring investors against political and non-commercial risks, providing advisory services, etc.

- World Bank: The World Bank (the World Bank was known as the International Bank for Reconstruction and Development (IBRD) before its growth and expansion) was set up to assist the reconstruction of war affected countries and to facilitate the development of the under-developed nations of the world. Moreover, apart from investing in infrastructure development, agriculture, health and industry, the World Bank is significantly involved in programmes to remove poverty, increasing the income of the poor and providing technological support.

- ITPO: The ITPO, or the Indian Trade Promotion Organisation, was formed on January 1, 1992, under the Companies Act, 1956. Its main objective is to maintain close interactions among traders, industry and the government. In order to fulfil this objective, the ITPO organises trade fairs and exhibitions within and outside the country, thereby helping export firms to interact with international trade bodies.

- IMF: The IMF, or the International Monetary Fund, came into existence in 1945 with the objective of creating and ensuring a healthy international monetary system. It aims at facilitating a system of international payments and adjustments in exchange rates among national currencies in order to bring about balanced growth at the international level and increase the levels of employment and income.

III. Long Answer Type Questions

Question 1. Rekha Garments has received an order to export 2000 men’s trousers to Swift Imports Ltd. located in Australia. Discuss the procedure that Rekha Garments would need to go through for executing the export order.

Answer: Rekha Garments will have to adopt the following procedures given below to execute the export order.

- As the exporter, it should first assess the credit worthiness of the importer. Swift Imports, through an enquiry. It should then ask for a letter of credit from the importer’s bank, guaranteeing to honour a draft of a specified amount drawn on it by the exporter.

- Once Rekha Garments is assured that it will be paid for the goods, it will need to register itself and secure an Importer Exporter Code number in order to obtain an export license.

- After obtaining the license, it should acquire pre-shipment finance from a bank in order to purchase raw materials to undertake production and packaging.

- With the finance made available, Rekha Garments can procure the raw materials and other inputs required and start the production process.

- After the goods are produced, Rekha Garments must get them inspected before exporting them. For this inspection, it must contact the Export Inspection Agency (EIA) or another designated agency and obtain a certificate of inspection.

- The exporter then needs to secure excise clearance, for which it must submit an invoice to the regional excise commissioner. The excise commissioner then examines the invoice and, if satisfied, issues the excise clearance to the exporter.

- Once the excise clearance is received, Rekha Garments needs a certificate of origin, which specifies the country in which the goods are being produced. It allows the importer to claim tariff concessions and other exemptions, if any.

- The next step is for the exporter to submit an application to a shipping company for booking shipping space in a vessel. In the application, it must provide details such as the type of goods to be shipped and the port of destination. After the application is received, the shipping company will issue a shipping order to the captain of its ship to inform him or her that the specified goods will be received on board after the customs clearance.

- The goods are then properly packed and labelled with Ml the necessary information such as the importer’s name, port of destination, and gross and net weight of the goods.

- Once the goods are ready for export, Rekha Garments must insure the goods against perils of the sea or any related damage.

- It must then secure customs clearance before loading the goods on the ship. For getting customs clearance, the exporter must submit the necessary documents to the customs appraiser at Customs House.

- After customs clearance, a mate’s receipt will be issued by the captain or commanding officer of the ship to the exporter as evidence that the cargo has been loaded on the ship.

- Later, a bill of lading will have to be obtained from the shipping company as a token of acceptance that the goods have been put on board in its vessel.

- After the goods are shipped, an invoice will have to be prepared by the exporter, which will include the quantity of goods sent and the amount to be paid by the importer.

- The exporter then needs to send a set of documents to the banker, which is to be handed over to the importer on acceptance of a bill of exchange. After receiving the bill of exchange, the importer, Swift Imports, will instruct its bank to transfer money to the exporter’s bank account.

- Last, the exporter would be required to collect a bank certificate of payment, which will state that the necessary documents, along with the bill of exchange, have been presented to the importer for payment, and that the payment has been received in accordance with the exchange control regulations.

Question 2. Your firm is planning to import textile machinery from Canada. Describe the procedure involved in importing.

Answer: In order to import textile machinery from Canada, the firm will have to take the following steps:

- The firm (the importer) should first make an enquiry about the price of the machinery, terms and conditions on which the selected Canadian exporter is willing to supply the goods and such related information. It should then send the trade enquiry to the exporter. On receipt of the trade enquiry, the exporter will prepare a quotation and send it to the importer.

- The importer must find out whether the goods to be imported are subject to import licensing. If needed, it must secure an import license.

- The firm must then convert domestic currency into foreign currency to make payment to the exporter. This is done by submitting an application to a bank in the prescribed form along with documents.

- Once the import license is obtained, the importer can place an order with the exporter specifying the price, quantity and quality of the goods required.

- The importer will be required to send a letter of credit to the Canadian exporter. This letter is obtained from the importer’s bank and acts as a bank guarantee that a draft of a specified amount drawn on it by the exporter will be honoured.

- The next step is for the importer to arrange for finance in order to make payment to the exporter on the arrival of the goods. This is necessary to avoid penalties on account of any delay in payment.

- Once the goods are shipped, the exporter will send a shipment advice to the importer. This document is proof of dispatch of the goods and contains information about the bill of lading, name of the vessel with date, port of export, description of goods, etc.

- The importer must then prepare a bill of exchange that is to be handed over to the exporter’s banker in exchange for the export documents. After this is done, the importer is required to instruct its bank to transfer money to the exporter’s bank account.

- An import general manifest will be issued by the person in charge of the carrier (ship or airliner) in which the goods are being imported. This is done in order to inform the officer in charge at the dock or the airport about the arrival of the goods. This document contains information about the goods being imported, and it is on the basis of this document that unloading of the cargo will take place.

- Once the goods arrive at the port, the importer must get customs clearance, which in turn requires a delivery order, a port duty dues receipt and a bill of entry.

Question 3. Discuss the principal documents used in exporting.

Answer: The following documents are required for an export transaction:

- Export Invoice: It is a seller’s bill which contains information about the quantity of goods, total value of goods, number and marks of packaging, name of the ship, etc.

- Packing List: It includes information related to the goods that are packed, such as the number of items packed in one package, details of goods contained in one package, etc.

- Certificate of Origin: Certificate of Origin specifies the country in which the goods being exported were produced. It allows the importer to claim tariff concessions and other exemptions.

- Certificate of Inspection: Certificate of Inspection is proof that the goods being exported are of good quality. The exporter contacts the Export Inspection Agency (EIA) or another designated agency and obtains the certificate of inspection after getting the goods inspected.

- Mate’s Receipt: It is a receipt issued by the captain or commanding officer of a ship to an exporter as evidence that the exporter’s cargo has been loaded on the ship. It contains information about the name of the vessel, berth, date of shipment, condition of the cargo when the goods were loaded, description of packages of the cargo, number of packages, marks on the packages, etc.

- Shipping Bill: It contains information regarding the specifications of the goods for export, such as the name of the vessel, port at which the goods are to be discharged, country of final destination and exporter’s name and address. This document forms an essential part of an export transaction as it is on the basis of this document that customs grants clearance to the export.

- Bill of Lading: Bill of lading is an essential document required for an export transaction. It is issued by the shipping company concerned as a token of acceptance that the goods have been put on board in its vessel. A bill of lading is an undertaking signed by the shipping company to transfer the goods to the port of destination. Bills of Lading are freely transferable.

- Airway Bill: It is issued by an airline as a token of acceptance that the goods for export have been put on board its aircraft.

- Marine Insurance Policy: Marine Insurance Policy is an insurance contract under which the insurance company concerned, in return for a premium, agrees to pay an exporter a specified amount in case of loss of goods or damage caused during transport by sea.

- Cart Ticket: Also known as a cart chit or a gate pass is prepared by an exporter and includes information about the exporter’s cargo.

- Letter of Credit: Letter of Credit is issued by the bank of an importer guaranteeing to honour a draft of a specified amount drawn on it by the exporter. A letter of credit enables the exporter to assess the creditworthiness of the importer and is the most appropriate and secure method of payment for settling international transactions.

- Bill of Exchange: Bill .of Exchange indicates the amount that an importer must pay to the bearer of the bill. On receiving a bill of exchange, the importer instructs its bank to transfer the amount to the exporter’s bank account.

- Bank Certificate of Payment: Bank Certificate of Payment indicates that the necessary documents, along with the bill of exchange, have been presented to the importer, and that payment from the importer has been received in accordance with the exchange control regulations.

Question 4. List and explain various incentives and schemes that the government has evolved for promoting the country’s foreign trade.

Answer: The following are some of the schemes and incentives adopted by the government to promote exports:

- Duty Drawback Scheme: Under the duty drawback scheme, exporters are either exempted from payment of excise duties or are refunded a certain percentage of the excise duty paid earlier. In case where inputs are used for export production, the custom duties paid on import of raw material and machines are refunded.

- Export Manufacturing under the Bond Scheme: This bond scheme enables exporters to undertake production of goods meant for exports without paying excise or other duties. In order to avail themselves of this scheme, exporters must sign an undertaking that the goods produced are meant only for exports and not for domestic consumption.

- Exemptions from Payment of Sales Tax: The goods that are meant for imports are not subjected to sales tax. The income earned by exporters (only those who run 100 per cent export-oriented units or units in export processing zones and special economic zones) from the export of goods is exempted from payment of income tax.

- Advance License Scheme: Advance License Scheme allows exporters to use inputs (those that are domestically produced or imported) without the payment of any duties. In addition, the scheme exempts exporters from paying custom duties in cases where the imported inputs are used for manufacturing goods meant for exports.

- Export Promotion Capital Goods (EPCG) Scheme: The EPCG Scheme promotes the import of goods for the production of export goods. Under the scheme, exporters are allowed to import goods at concessional rates of custom duties. However, to avail themselves of this scheme, exporters must fulfill certain export obligations stated under the scheme. ‘

- Scheme of Recognizing Export House, Trading House and Superstar Trading House: This scheme aims at facilitating well-established trading houses to market their products globally. Under the scheme, selected exporting firms are given the status of export house, trading house and star trading house by the government. This status is given on the basis of the past export performances of export firms.

Question 5. Identify various organizations that have been set up in the country by the government for promoting country’s foreign trade.

Answer: In order to promote foreign trade, the Government has set up the following institutions:

- Indian Institute of Foreign Trade (IIFT): Established in 1963 under the Societies Registration Act, the IIFT is an autonomous body responsible for the management of the country’s foreign trade. It is also a deemed university that provides training

in international trade, conducts research in areas of international business and disseminates data related to international trade. - Export Inspection Council (EIC): The EIC was established by the Government of India under Section 3 of the Export Quality Control and Inspection Act, 1963, with the objective of promoting exports through quality control and pre-shipment inspections. According to this act, all goods that are meant for exports (except some commodities) must pass through the EIC for quality inspection.

- Indian Institute of Packaging (IIP): The IIP is a training and research institute established in 1966 by the joint efforts of the Ministry of Commerce of the Government of India, Indian Packaging Industry and Allied Industries. The institute caters to the packaging needs of domestic manufacturers and exporters.

- Indian Trade Promotion Organisation (ITPO): The ITPO was formed on January 1, 1992, under the Companies Act, 1956. Its main objective is to maintain close interactions among traders, industry and the government. In order to fulfill this objective, the ITPO organizes trade fairs and exhibitions within and outside the country, thereby helping export firms to interact with international trade bodies.

- Department of Commerce: The Department of Commerce is the apex body in the Ministry of Commerce of the Government of India and is responsible for formulating policies related to foreign trade as well as evolving import and export policies for the country. It is responsible for all matters related to the country’s external trade.

- Export Promotion Councils (EPCs): Registered under the Companies Act or the Societies Registration Act, EPCs are non-profit organizations that are responsible for promoting the exports of particular products. However, the product promoted by a particular EPC must fall under its jurisdiction.

Question 6. What is World Bank? Discuss its various objectives and role of its affiliated agencies.

Answer: The World Bank is an International Financial Institution that was established in 1944 at the Bretton Woods Conference.

The following are some of the main objectives behind the setting up of the World Bank:

- To facilitate the task of reconstruction of the war-affected European countries.

- To focus on the development of underdeveloped nations of the world.

- To encourage investments in infrastructure development, agriculture, health and industry;

- To eradicate poverty, increase the income of the poor and provide technological support.

The following are some of the affiliates of the World Bank:

- MIGA: MIGA, or the Multinational Investment Guarantee Agency, was established in April 1988 with the objective of encouraging foreign direct investments in the less developed nations of the world. It also aims at insuring investors against political and non-commercial risks and providing advisory services.

- IFC: The IFC, or the International Finance Corporation, was formed in 1956 as a separate legal entity to provide finance to the private sector in developing nations. Although the IFC is an affiliate of the World Bank, it has its own funding, besides functions that are managed independently.

- IDA: The IDA, or the International Development Association, was established in 1960 with the affiliation to the World Bank. The basic objective of the association is to provide loans and grants on a soft-loan basis to the less developed member countries—it aims at providing loans at concessional rates to the member countries

whose per capita income is very low. It is because of this objective that the IDA is also known as the World Bank’s soft-loan window.

Question 7. What is IMF? Discuss its .various objectives and functions.

Answer: The IMF, or the International Monetary Fund, came into existence in 1945 with the objective of establishing a healthy and orderly monetary system. It aimed at facilitating a system of international payments and taking care of the adjustments in exchange rates among national currencies. It is one of the three international institutions—the other two being the World Bank and the International Trade Organization—that were created for facilitating and monitoring the economic development of the world.

Objectives of the IMF

- To aid the balanced growth of international trade and market, thereby promoting the growth of employment and income;

- To promote international monetary cooperation among the member countries;

- To facilitate the orderly exchange of goods between the member countries;

- To facilitate international payments with respect to the exchange transactions between the member countries.

Functions of the IMF

- Providing short-term credit to member countries;

- Maintaining stability in the exchange rate of the member countries;

- Fixing and altering the value of a country’s currency whenever required, to facilitate the adjustment of exchange rate of member countries;

- Collecting the currencies of member countries so as to allow them to borrow the currency of other nations;

- Lending foreign currency to member nations and facilitating international payments with respect to the exchange transactions between member countries.

Question 8. Write a detailed note on features, structure, objectives and functioning of WTO.

Answer: Features of the WTO (World Trade Organisation):

- It governs trade in goods, services and intellectual property rights among the member countries.

- It is a body created by an international treaty with the approval of the governments and legislatures of the member states.

- The decisions of the WTO are made by the governments of the member nations on the basis of consensus.

Structure of the WTO

On January 1, 1995, the General Agreement on Tariffs and Trade (GATT) was transformed into the WTO to facilitate international trade among the member countries. The WTO was made much more powerful than GATT, by removing tariff and non-tariff barriers between the member nations. It is a permanent body created by an international treaty and represents the implementation of the original proposal of the ITO.

Objectives of the WTO

- Reducing tariff and other non-trade barriers imposed by different nations;

- Ensuring sustainable development by optimally using the world resources;

- Developing a more integrated, feasible and stable trading system.

Functions of the WTO

- Providing an environment to the member countries such that they can put forward their grievances before the WTO without any hesitation;

- Resolving trade disputes among member nations;

- Eliminating discriminations in trade relations by laying down a commonly accepted code of conduct;

- Creating better understanding between member countries by consulting with the IMF, the World Bank and other affiliates.

MORE QUESTIONS SOLVED

I. Very Short Answer Type Questions

Question 1. Give full form of EPZ and SEZ.

Answer: Export Promotion Zones (EPZ) and Special Economic Zones (SEI)

Question 2. What is the main objective of WTO?

Answer: To promote free and far trade amongst nations.

Question 3. Name any two WTO Agreements.

Answer: GATT and GATS

Question 4. Name the most important document of export.

Answer: Export License

Question 5. Name the most important document used in import.

Answer: Import License

Question 6. List various affiliated bodies of World Bank.

Answer:

- International Bank for Reconstruction and Development (IBRD),

- International Finance Corporation (IFC),

- International Development Association (IDA),

- Multilateral Investment Guarantee Agency (MIGA),

- International Centre for Settlement of Investment Disputes (ICSID).

Question 7. Explain the term FOB.

Answer: Free On Board (FOB) indicates that the supplier pays the shipping costs that usually include the insurance costs from the point of production to a specified destination, at which point the buyer takes responsibility.

Question 8. Which certificate is necessary to prove that goods are produced in the home country itself ?

Answer: Certificate of Origin

Question 9. Define Mate’s Receipt.

Answer: Mate Receipt is a receipt issued by the commanding officer of the ship when the cargo is loaded on the board.

Question 10. What is Performa Invoice?

Answer: The exporter sends reply to the enquiry of the importer in the form of a quotation. It is called Performa Invoice.

Question 11. Who is a clearing agent?

Answer: “Clearing and Forwarding Agent” means any person who is engaged in providing’any service, either directly or indirectly, concerned with the clearing and forwarding operations in any manner to any other person and includes a consignment agent.

Question 12. What is the purpose of pre-shipment finance?

Answer: As soon as order is confirmed and letter of credit is received, the exporter approaches the bank to receive pre-shipment finance which he needs to buy raw materials and other inputs to produce goods to be exported. Firms require finance for various activities such as purchase of raw material and manufacture of goods. In the case of exporters, this finance is obtained from banks in the form of advances known as pre-shipment finance.

Question 13. Define Export Processing Zones.

Answer: Export Processing Zones: These are industrial estates which firms enclaves from the domestic tariff area. They aim at providing an internationally competitive duty free environment for export production at low cost. Recently these have been converted into Special Economic Zones.

Question 14. Name the certificate which is used for ensuring timely payment.

Answer: Letter of Credit

Question 15. How many Export Promotion Councils are there in India?

Answer: Twenty one.

Question 16. How many Commodity Boards are there in India?

Answer: Seven

Question 17. How many regional and international offices does ITPO have?

Answer: Five regional and four international

Question 18. When was State Trading Corporation established?

Answer: May, 1956

Question 19. When was IIFT formed?

Answer: 1963

Question 20. Write the full form of ICSID.

Answer: International Center for Settlement of Investment Disputes.

Question 21. What was the objective of MIGA?

Answer: To encourage flow of direct flow of investment in less developed member countries.

Question 22. Which agency of World Bank provides loan to private sector of developing countries?

Answer: International Finance Corporation (IFC).

Question 23. Write the full form of DTA.

Answer: Domestic Tariff Area

Question 24. Santa Cruz is famous for which exclusive items?

Answer: Electronic goods and gems and jewellery.

Question 25. What is Advance License Scheme?

Answer: It is a scheme under which an exporter is allowed duty free supply of domestic as well as imported inputs required for the manufacture of exports goods.

II. Short Answer Type Questions

Question 1. Explain the term FOB.

Answer: Free On Board (FOB) indicates that the supplier pays the shipping costs that include the insurance costs from the point of production to a specified destination, at which point the buyer takes responsibility.

Description: The FOB is an important part in a purchase contract. It indicates who selects the carrier, which party is to bear the freight charges and who has the title to the goods during the shipment.

There are two types of FOB contract.

FOB Destination: In FOB destination (the standard and most commonly used) the seller is the owner of goods while in transit and is responsible for any loss or damage up to the time of delivery. It is expressed as FOB Mumbai or FOB Cochin. It could be to negotiate the shipping separately from the purchase of goods or if a party wants all the shipping to be done by a specific carrier.

FOB Origin: When no FOB terms are discussed or not mentioned in the contract or purchase order, then, in accordance with the Uniform Commercial Code (UCC) the term is FOB Origin. The buyer is then responsible for freight and damaged goods.

Question 2. Write short note on Indent House and Dock Challan.

Answer: Meaning of Indent House: Import of goods from a foreign country can be affected in two ways. The import of goods can take place directly or through a middleman. The import of goods through an intermediary is called an Indent House. Indent Houses are of two types. They may be representative or agents of foreign producers or exporters or they may be independent firms engaged in foreign trade. At the time of securing order, the indent firm requests the merchant to sign an Indent Form which services as a letter of authority by the merchant to the Indent House to go for order of the specified items stated in the form. The Indent House brings the following advantages:

- It helps the small dealers to participate in foreign trade.

- The bargaining is done by the Indent Forms and therefore helps in getting the goods at a cheaper rate.

- The financing of import trade is facilitated by the Indent House.

Dock Challan: When all formalities of customs are completed then dock charges are required to be paid. When he pays these charges, the importer or his clearing agent specifies the amount of dock dues in a challan or in any firm. It is called Dock Challan.

Question 3. Who is a clearing agent?

Answer: “Clearing and forwarding agent” means any person who is engaged in providing any service, either directly or indirectly, concerned with the clearing and forwarding operations in any manner to any other person and includes a consignment agent.

A clearing and forwarding agent normally undertakes the following activities:

- Receiving the goods from the factories or premises of the principal or his agents;

- Warehousing these goods;

- Receiving dispatch orders from the principal;

- Arranging dispatch of goods as per the directions of the principal by engaging transport on his own or through the authorised transporters of the principal;

- Maintaining records of the receipt and dispatch of goods and the stock available at the warehouse.

Question 4. Why did WTO establish? What are its objectives?

Answer: WTO was established with an intention of expanding the scope of the organisation by including services, investment and intellectual property rights.

Main objectives of WTO:

- Improving living standards of people, ensuring full employment of resources, increase in world trade and production, optimizing use of economic resources.

- Ensuring equitable division of the benefits of international trade

- Optimizing the resources of world resources so as to attain sustainable development.

III. Long Answer Type Questions

Question 1. Explain the steps of export procedure.

Answer: Export procedure: Imports and Exports (control) Act, 1947 regulates exports of goods from India. The Central Government announces rules, policies, procedures and incentives for exports from time to time. The procedure of export of goods from India is guided by these rules and regulations of the Government of India. But, in general, an export transaction has to pass through the following stages:

- Receiving enquiries and sending quotations: The exporter receives order from importer and sends quotations for goods.

- Receiving of Order or Indent: The order is received for export of goods containing instructions regarding goods, price, quality, quantity etc.

- Credit enquiry or obtaining Letter of Credit: The credit worthiness of the importer is verified.

- Obtaining Export License and Quota: The exporter of goods gets a license under Import and Export Control Act for sending the goods.

- Compliance with Foreign Exchange Regulations: The exporter gives an undertaking to comply with foreign exchange regulations and deposit the exchange with Reserve Bank of India on receipt of price.

- Fixing the Exchange Rate: The exchange rate is fixed on which the price is to be received.

- Obtaining the Shipping Order: The exporter takes steps in regard to packing and marketing of goods. Packing is done as per the instructions of the indent.

- Preparation of Invoice and Consular Invoice: After completing other formalities the exporter prepares the invoice. The invoice contains details such as name of ship, destination, packing marks, etc.

- Obtaining Customs Permit: Some customs formalities are observed before goods leave the country. Custom authorities clear the goods after getting export duties.

- Paying Dock Dues: Dock dues are paid to dock authorities.

- Shipping of Goods: Before the goods are actually loaded custom officials verify the goods and their quantity.

- Mate’s Receipt: A receipt for the goods is issued by captain of the ship or his assistant acknowledging the receipt of goods.

- Bill of Lading: It is a memorandum signed by master of ship acknowledging the receipt of exporter’s goods.

- Effecting Insurance: An insurance policy is obtained to safeguard the goods against the peril of the seas.

- Certificate of Origin: Some importing countries require a certificate of origin for goods. This certificate is issued by the designate authorities of the country.

- Securing Payment: The exporter will secure payment for the exports.

- Obtaining Various Export Incentives: The exporter may be allowed some incentives by the government and these are received after completing the process of export.

Question 2. Why is export promotion necessary?

Answer:

- To Earn Foreign Exchange: Every country in the world is trying to earn a share in the global trade. This is due to the lowering of trade barriers since the inception of the World Trade Organisation (WTO), increased import bills, and increased global competition in the domestic market. Also, most developing countries row heavily from financial institutions like the World Bank and the International Monetary Fund (IMF) and other sources to finance their developmental activities and reduce the balance of payment deficits. It is, therefore, imperative that the import bills as well as foreign loans be paid back in foreign exchange. In order to achieve this, earning foreign exchange through various export activities is the need of the hour.

- To Motivate Organisations to Export: In order to motivate organisations to export and earn precious foreign exchange, governments offer certain incentives. These incentives help reduce the tax burden of the exporters and also achieve a competitive price-edge for their products in foreign markets. However, being a member of WTO, each country has to ensure that the incentives offered by its government do not give an unfair advantage to the exporters. Thus, no country is to give special trading advantages to another or to discriminate against its all nations stand on an equal basis and share the benefits of any move towards lower trade barriers (branch). Also, all export incentives have to comply with WTO norms and should be in line with its various principles.

- To Promote Interests of Indian Exporters and keeping commitment of WTO: In India, the framework of export incentives in the form of duty exemption and remission schemes has been devised keeping in mind the interests of exporters as well as the commitments India has made to WTO.

The Duty Exemption Scheme helps exporters import duty-free inputs required for manufacturing export products. The Duty Remission Schemes enable post-exports replenishment/remission of duty on inputs. - To Import Capital Goods: In addition to this, the Export Promotion Capital Goods (EPCG) scheme enables exporters to import capital goods at concessional rate of duty and suitable export obligation.

- To Reduce Bureaucratic Hurdles: The incentives detailed above are available to all eligible exporters in India. In addition, the government has launched the very ambitious scheme of Special Economic Zones (SEZs) in order to reduce bureaucratic hurdles in importing inputs for exports and exporting finished products from India. These SEZs are modelled on the highly successful Chinese Economic Zones. It is expected that the SEZs will be the engines of growth in international trade for India.

- To Correct Unfavourable Balance of Trade: During the period of planning, except two years, all other years have witnessed unfavourable balance of trade. It not only reduced the foreign exchange reserves of India but also made it difficult to achieve plan targets. Successful completion of plans, therefore, calls for turning of unfavourable balance of trade into favourable one which requires increase in exports.

- To Reduce Foreign Loans: India has to row large foreign funds to import essential machinery for economic and industrial development. Till March 2009, India had contracted foreign loans amounting to ? 11, 42,618 crore. These loans are to be repaid one day. To pay interest and repay the principal amount of these loans, it is necessary that a policy of export promotion be adopted. Foreign exchange earned as a result of larger exports will be utilized for the repayment of foreign loans.

- To Achieve the Objective of Self-Reliance: One of the main objectives of Indian

plans is to make the country independent of foreign assistance. To achieve this objective, it is necessary to promote exports. By accelerating exports, large amount of foreign currency can be earned. ‘ - To Sell Surplus Production: During the period of planning, new industries have been set-up in India. In order to increase the sale of the products of these industries, their export is to be promoted. It becomes easy to increase exports under export promotion program.

- To Finance Imports: Successful execution of the plans necessitates import of machines and other capital goods from abroad. To earn necessary foreign exchange to meet their import bills, it becomes necessary to increase exports.

Question 3. Explain different organizations involved in export promotion or facilitating foreign trade.

Answer: Following institutions help in promoting exports or facilitating foreign trade.

- Department of Commerce: It is under Ministry of Commerce, Government of India. It is the apex institution responsible for the country’s external trade and all matters connected with it. It formulates policies for foreign trade. It also formulates export and import policy of the country.

- Export Promotion Council (EPC): These are non-profit organizations which are registered with either Companies Act or Societies Registration Act. They aim at promoting and developing the country’s exports of particular products falling under their jurisdiction.

- Commodity Boards: Commodity boards are the boards established by Indian Government for development of production of traditional commodities and their products. There are 7 boards at present.

- Export Inspection Council (EIC): It was established under Export Quality Control and Inspection Act, 1963 which aims at sound development of export trade using quality control and pre-shipment inspection.

- Indian Trade Promotion Organization (ITPO): It was set up on 1 January, 1992 under the Companies Act, 1956 by the Ministry of Commerce. It is a service organization and maintains regular and close interaction with trade, industry and Government. It has five regional offices in Mumbai, Bangalore, Kolkata, Kanpur and Chennai and four international offices in USA, Germany, Japan and UAE.

- Indian Institute of Foreign Trade (IIFT): It was set up in 1963 as an autonomous body registered under the Societies Registration Act with the prime objective of professionalising the country’s foreign trade management.

- Indian Institute of Packaging (IIP): It was set up in 1966. It is a training cum research institute pertaining to packaging and testing. It caters to packaging needs with regard to both the domestic and export market. Its headquarters are in Mumbai and it has three regional offices in Kolkata, Delhi and Chennai.

- State Trading Organizations: It was established in May, 1956. Its main aim is to stimulate trade primarily export trade among different trading partners of the world. Under it more organizations were set up later like Metals and Minerals Trading Corporation (MMTC) and Handloom and Handicrafts Export Corporation (HHEC).

Question 4. Write a note on the functions of World Bank.

Answer: World Bank is playing main role of providing loans for development works to member countries, especially to underdeveloped countries. The World Bank provides long-term loans for various development projects of 5 to 20 years duration.

- World Bank provides various technical services to the member countries. For-this purpose, the bank has established The Economic Development Institute and a Staff College in Washington.

- Bank can grant loans to a member country up to 20% of its share in the paid-up capital.

- The quantities of loans, interest rate and terms and conditions are determined by the bank itself.

- Generally, bank grants loans for a particular project duly submitted to the bank by the member country.

- The debtor nation has to repay either in reserve currencies or in the currency in which the loan was sanctioned.

- Bank also provides loan to private investors belonging to member countries on its own guarantee, but for this loan private investors have to seek prior permission from those counties where this amount will be collected.

Question.5. Explain all the documents used in export procedure.

Answer. Documents required for an international sale can vary significantly from transaction to transaction, depending on the destination and the product being shipped. At a minimum, there will be two documents: the invoice and the transport document. The buyer will usually provide the seller with a list of documents needed to get the goods into his country as expeditiously and inexpensively as possible. Some documentary requirements are not open to negotiation, as they are needed by the importer to clear customs at the port of destination.

International market involves various types of trade documents that need to be produced while making transactions. Each trade document is different from other and present the various aspects of the trade like description, quality, number, transportation medium, indemnity, inspection and so on. So, it becomes important for the importers and exporters to make sure that their documents support the guidelines as per international trade transactions. A small mistake could prove costly for any of the parties.

For example, a Trade Document about the Bill of Lading is a proof that goods have been shipped on board, while Inspection Certificate, certifies that the goods have been inspected and meet quality standards. So, depending on these necessary documents, a seller can assure a buyer that he has fulfilled his responsibility whilst the buyer is assured of his request being carried out by the seller.

The following is a list of documents often used in international trade:

- Air Waybill;

- Bill of Lading;

- Certificate of Origin;

- Draft (or Bill of Exchange);

- Insurance Policy (or Certificate);

- Packing List/Specification;

- Inspection Certificate.

- Air Waybills: Air Waybills make sure that goods have been received for shipment by air. A typical air waybill sample consists of of three originals and nine copies. The first original is for the carrier and is signed by a export agent; the second original, the consignee’s copy, is signed by an export agent; the third original is signed by the carrier and is handed to the export agent as a receipt for the goods.

- Bill of Lading (B/L): Bill of Lading is a document given by the shipping agency for the goods shipped for transportation form one destination to another and is signed by the representatives of the carrying vessel.

Bill of lading is issued in the set of two, three or more. The number in the set will be indicated on each bill of lading and all must be accounted for. This is done due to the safety reasons which ensure that the document never comes into the hands of an unauthorised person. Only one original is sufficient to take possession of goods at port of discharge so, a bank which finances a trade transaction will need to control the complete set. The Bill of Lading must be signed by the shipping company or its agent, and must show how many signed originals were issued.

To be acceptable to the buyer, the B/L should:

1. Carry an “On Board” notation to showing the actual date of shipment, (Sometimes however, the “on board” wording is in small print at the bottom of the B/L, in which cases there is no need for a dated “on board” notation to be shown separately with date and signature.)

2. Be “clean” have no notation by the shipping company to the effect that goods/ packaging are damaged. - Certificate of Origin:

The Certificate of Origin is required by the custom authority of the importing country for the purpose of imposing import duty. It is usually issued by the Chambers of Commerce and contains information like seal of the chamber, details of the good to be transported and so on.

The certificate must provide that the information required by the credit and be consistent with all other document. It would normally include :

1. The name of the company and address as exporter.

2. The name of the importer.

3. Package numbers, shipping marks and description of goods to agree with that on other documents.

4. Any weight or measurements must agree with those shown on other documents.

5. It should be signed and stamped by the Chambers of Commerce. - Bill of Exchange:

Bill of Exchange is a special type of written document under which an exporter ask importer a certain amount of money in future and the importer also agrees to pay the importer that amount of money on or before the future date. This document has special importance in wholesale trade where large amount of money is involved.

On the basis of the due date there are two types of Bill of Exchange:

Bill of Exchange after Date: In this case the due date is counted from the date of drawing and is also called bill after date.

Bill of Exchange after Sight: In this case the due date is counted from the date of acceptance of the bill and is also called bill of exchange after sight. - Insurance Certificate:

Also known as Insurance Policy, it certifies that goods transported have been insured under an open policy and is not actionable with little details about the risk covered. It is necessary that the date on which the insurance becomes effective is same or earlier than the date of issuance of the transport documents.

Also, if submitted under a LC, the insured amount must be in the same currency as the credit and usually for the bill amount plus 10 per cent.

The requirements for completion of an insurance policy are as follows:

(а) The name of the party in favour of which the documents has been issued.

(b) The name of the vessel or flight details.

(c) The place from where insurance is to commerce typically the sellers warehouse or the port of loading and the place where insurance cases usually the buyer’s warehouse or the port of destination.

(d) Insurance value that is specified in the credit.

(e) Marks and numbers to agree with those on other documents.

(f) The description of the goods, which must be consistent with that in the credit and on the invoice.

(g) The name and address of the claims settling agent together with the place where claims are payable.

(h) Countersigned where necessary.

(i) Date of issue to be no later than the date of transport documents unless cover is shown to be effective prior to that date. - Packing List: Also known as packing specification, it contains details about the packing materials used in the shipping of goods. It also includes details like measurement and weight of goods.

The Packing List must:

(i) have a description of the goods (“A”) consistent with the other documents.

(ii) have details of shipping marks (“B”) and numbers consistent with other documents. - Inspection Certificate: Certificate of Inspection is a document prepared on the request of seller when he wants the consignment to be checked by a third party at the port of shipment before the goods are sealed for final transportation.

Question 6. Explain all the documents used in import procedure.

Answer: Following documents are used in import procedure:

- Trade Enquiry: Trade Enquiry is a written request by an importing firm to the exporter for supply of information regarding the price and various terms and conditions on which the exporter exports goods.

- Performa Invoice: Performa Invoice is a document which contains details of quality, grade, design, size, weight and price of goods to be exported and the terms and conditions on which goods will be exported.

- Indent: It is a document in which the importer orders for supply of requisite goods to the exporter and contains information on quantity and quality of goods, price to be charged, mode of forwarding the goods, type of packing and mode of payment etc.

- Letter of Credit (L/C): A letter issued by an importer’s bank guaranteeing payment upon presentation of specified trade documents (Invoice, Bill of Lading, Inspection and Insurance Certificates, etc.).

- Shipping Advice: It is a document which exporter sends to the importer informing that goods have been shipped giving details of name of the vessel with date,the port of export, description of goods and the quantity and the date of sailing etc

- Bill of Lading (B/L): A document that establishes the terms and conditions of a contract between a shipper and a shipping company under which freight is to be moved between specified points for a specified charge. The B/L is negotiable or non- negotiable forms.

- Bill of Entry: It is a form supplied by the customs office and filled by the importer once the goods are received. Bill of Entry is submitted at the customs office with information such as the name and address of the importer, name of the ship in which the goods were transported, number of packages, marks on the package, description of imported goods, quantity and value of the imported goods, name and address of the exporter, port of destination and customs duty payable.

- Bill of Exchange: It is an order to the importer to pay a certain amount of money to, or to the order of, a certain person or to the bearer of the instrument. It may be sight draft or usance draft.

- Import General Manifest: It is a document which contains the details of the imported goods. It is a document on the basis of which uploading of cargo takes place.

- Sight Draft: It is a type of bill of exchange in which the drawer of bill of exchange instructs the bank to hand over the relevant documents to the importer only against payment.

- Usance Draft: It is a type of bill of exchange in which the drawer of bill of exchange instructs the bank to hand over the relevant documents to the importer only against acceptance of the bill of exchange.

- Dock Challan: When all formalities of customs are completed then dock charges are required to be paid. When he pays these charges, the importer or his clearing agent specifies the amount of dock dues in a challan or in any firm. It is called Dock Challan.

Question 7. Explain in brief international trade institutions and agreement.

Answer: Following are important international institutions related to international trade.

I. World Bank

The World Bank (the World Bank was known as the International Bank for Reconstruction and Development (IBRD) before its growth and expansion) was set up to assist the reconstruction of war affected countries and to facilitate the development of the underdeveloped nations of the world. Moreover, apart from investing in infrastructure development, agriculture, health and industry, the World Bank is significantly involved in programmes to remove poverty, increasing the income of the poor and providing technological support.

Five Agencies of World Bank

- International Bank for Reconstruction and Development (IBRD): The International Bank for Reconstruction and Development (IBRD), established in 1945, which provides debt financing on the basis of sovereign guarantees.

- International Finance Corporation (IFC): The International Financial Corporation (IFC), established in 1956, which provides various forms of financing of without sovereign guarantees, primarily to the private sector.

- International Development Association (IDA): The International Development Association (IDA), established in 1960, which provides concessional financing (interest- free loans or grants), usually with sovereign guarantees.

- Multilateral Investment Guarantee Agency (MIGA): The Multilateral Investment Guarantee Agency (MIGA), established in 1988, which provides insurance against certain types of risks, including political risk, primarily to the private sector. The Multinational Investment Guarantee Agency, or MIGA, was established in April 1988 with the objective of encouraging foreign direct investment in the less developed countries. It aims at insuring investors against political and non-commercial risks, providing advisory services, etc..

- International Centre for Settlement of Investment Disputes (ICSID): The International Centre for Settlement of Investment Disputes (ICSID), established in 1966, which works with governments to reduce investment risk.

Other Institutions:

- UNCTAD: The United Nation Conference on Trade and Development, or UNCTAD, was established in 1964 with the objective of integrating the developing countries with the world economy through discussions. It undertakes activities such as collecting research and data for policy making and extending technical assistance to the less developed countries as per their requirements.

- ITPO: The ITPO, or the Indian Trade Promotion Organisation, was formed on January 1, 1992, under the Companies Act, 1956. Its main objective is to maintain close interactions among traders, industry and the government. In order to fulfill this objective, the ITPO organizes trade fairs and exhibitions within and outside the country, thereby helping export firms to interact with international trade bodies.

- INTERNATIONAL MONETARY FUND: The IMF, or the International Monetary Fund, came into existence in 1945 with the objective of creating and ensuring a healthy international monetary system. In 2005, it had 191 members. It aims at facilitating a system of international payments and adjustments in exchange rates among national currencies in order to bring about balanced growth at the international level and increase the levels of employment and income.

- WORLD TRADE ORGANIZATION (WTO): Probably the only issue in economics where economists have a unanimous approach that free trade will bring about greater specialization and through comparative advantage will increase productivity and the rate of economic growth. For a long time, an effort is being made to bring all countries under preview of multilateral trade agreements.

WTO AGREEMENTS

Major WTO agreements are as follows:

- GATT: General Agreements on Trade and Tariff which preceded WTO is very much a part of WTO agreements.

- Agreements on Textile and Clothing (ATC): Under the ATC, the developed countries agreed to remove quota restrictions in a phased maimer during a period of 10 years starting from 1995. It is considered as a landmark achievement of WTO which made trade in clothing and textile as quota free.

- Agreement on Agriculture (AOA): It is a significant step in an orderly and fair trade in agricultural products. The developed countries have agreed to lower down the customs duties on their imports and subsidies to the exports of agricultural products. The developing countries have been exempted from making similar reciprocal offers.

- General Agreement on Trade in Services (GATS): Due to GATS the basic rules which govern trade in goods have become applicable to trade in services.

- Agreement on Trade Related Aspects of Intellectual Property Rights (TRIPS): The Agreement on Trade Related Aspects of Intellectual Property Rights (TRIPS) is an international agreement administered by the World Trade Organization (WTO) that sets down minimum standards for many forms of intellectual property (IP) regulations as applied to nationals of other WTO members. It was negotiated at the end of the Uruguay Round of the General Agreement on Tariffs and Trade (GATT) in 1994. The TRIPS agreement introduced intellectual property law into the international trading system for the first time and remains the most comprehensive international agreement on intellectual property to date. In 2001, developing countries, concerned that developed countries were insisting on an overly narrow reading of TRIPS, initiated a round of talks that resulted in the Doha declaration. The Doha declaration is a WTO statement that clarifies the scope of TRIPS, stating for example that TRIPS can and should be interpreted in light of the goal “to promote access to medicines for all.”

Question 8. Explain the major export promotion measures adopted by the government.

Answer: The major export promotion measures adopted by the government can be grouped under two heads:

I. Foreign Trade Promotion:

- Duty Drawback Scheme: Goods meant for exports are not consumed domestically, these are not subjected to payment of various excise and customs duties, therefore, excise duties paid on such goods are refunded on production of proof of export of these goods. It is called duty drawback.

- Export Manufacturing under Bond Scheme: This facility entitles firms to produce goods without payment of excise and other duties.

- Exemption from Payment of Sales Taxes: Goods meant for export purposes are not subject to sales tax. Even for a long time, income derived from export operations had been exempted from payment of income tax.

- Advance License Scheme: It is a scheme under which an exporter is allowed duty free supply of domestic as well as imported inputs required for the manufacture of exports goods.

- Export Promotion Capital Goods Scheme (EPCG): The main objective of this scheme is to encourage the import of capital goods for export production. This scheme allows export firms to import capital goods at negligible or lower rates of customs duties subject to actual user condition and fulfillment of specified export obligation.

- Scheme of recognizing Export Firms as Export House, Trading House and Superstar Trading House: Their objective is to promote established exporters and assist them in marketing their products in international markets. The government grants the status of Export House, Trading House, Star Trading House, etc.

- Export of Services: In order to boost the export of services, various categories of services houses have been recognized.

- Export Finance: Exporters require finance for the manufacture of goods. Therefore, two types of export finances are made available to the exporters by authorised banks.

- Export Processing Zones (EPZ): These are industrial estates which firms enclaves from the Domestic Tariff Area. They aim at providing an internationally competitive duty free environment for export production at low cost. Recently these have been converted into Special Economic Zones.

- EOU: 100% Export Oriented Units. This scheme was started in 1981. It is complementary to the scheme of EPZ. These have been set up with a view to generating additional production capacity for exports by providing an appropriate policy framework, flexibility of operations and incentives.

II. Organizational Support

- Indian Institute of Foreign Trade (IIFT): Established in 1963 under the Societies Registration Act, the IIFT is an autonomous body responsible for the management of the country’s foreign trade. It is also a deemed university that provides training in international trade, conducts research in areas of international business and disseminates data related to international trade.

- Export Inspection Council (EIC): The EIC was established by the Government of India under Section 3 of the Export Quality Control and Inspection Act, 1963, with the objective of promoting exports through quality control and pre-shipment inspections. According to this act, all goods that are meant for exports (except some commodities) must pass through the EIC for quality inspection.

- Indian Institute of Packaging (IIP): The IIP is a training and research institute established in 1966 by the joint efforts of the Ministry of Commerce of the Government of India, Indian Packaging Industry and Allied Industries. The institute caters to the packaging needs of domestic manufacturers and exporters.

- Indian Trade Promotion Organisation (ITPO): The ITPO was formed on January 1, 1992, under the Companies Act, 1956. Its main objective is to maintain close interactions among traders, industry and the Government. In order to fulfill this objective, the ITPO organizes trade fairs and exhibitions within and outside the country, thereby helping export firms to interact with international trade bodies.

- Department of Commerce: The Department of Commerce is the apex body in the Ministry of Commerce of the Government of India and is responsible for formulating policies related to foreign trade as well as evolving import and export policies for the country. It is responsible for all matters related to the country’s external trade.

- Export Promotion Councils (EPCs): Registered under the Companies Act or the Societies Registration Act, EPCs are non-profit organizations that are responsible for promoting the exports of particular products. However, the product promoted by a particular EPC must fall under its jurisdiction.

IV. Higher Order Thinking Skills (HOTS)

Question 1. Up-to-date Garments has ordered for export of ready made garments. What steps must be followed by the company to receive the import order?

Answer: Following steps should be taken by Up-to-date Garments for export of readymade garments: